Time Warner Cable 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Combinations and Disclosures

In December 2010, the FASB issued authoritative guidance that updates existing disclosure requirements related to

supplementary pro forma information for business combinations. Under the updated guidance, a public entity that

presents comparative financial statements should disclose revenue and earnings of the combined entity as though the

business combination that occurred during the current year had occurred as of the beginning of the comparable prior

annual reporting period only. The guidance also expands the supplemental pro forma disclosures to include a description

of the nature and amount of material, nonrecurring pro forma adjustments directly attributable to the business

combination included in the reported pro forma revenue and earnings. This guidance will be effective for TWC on

January 1, 2011 and will be applied prospectively to business combinations that have an acquisition date on or after

January 1, 2011.

Impairment Testing for Goodwill and Other Intangible Assets

In December 2010, the FASB issued authoritative guidance that provides additional guidance on when to perform the

second step of the goodwill impairment test for reporting units with zero or negative carrying amounts. Under this

guidance, an entity is required to perform the second step of the goodwill impairment test for reporting units with zero or

negative carrying amounts if qualitative factors indicate that it is more likely than not that a goodwill impairment exists.

The qualitative factors are consistent with the existing guidance, which requires that goodwill of a reporting unit be tested

for impairment between annual tests if an event occurs or circumstances change that would more likely than not reduce the

fair value of a reporting unit below its carrying amount. This guidance will be effective for TWC on January 1, 2011 and is

not expected to have a material impact on the Company’s consolidated financial statements.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

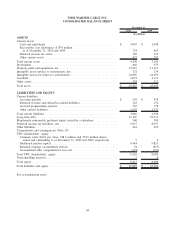

Cash and Equivalents

Cash and equivalents include money market funds, overnight deposits and other investments that are readily

convertible into cash and have original maturities of three months or less. Cash equivalents are carried at cost, which

approximates fair value.

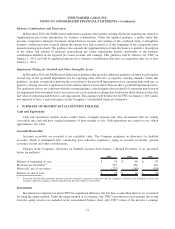

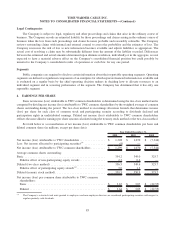

Accounts Receivable

Accounts receivable are recorded at net realizable value. The Company maintains an allowance for doubtful

accounts, which is determined after considering past collection experience, aging of accounts receivable, general

economic factors and other considerations.

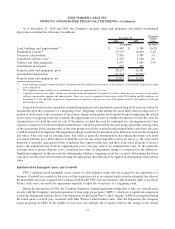

Changes in the Company’s allowance for doubtful accounts from January 1 through December 31 are presented

below (in millions):

2010 2009 2008

Balance at beginning of year . ........................... $ 74 $ 90 $ 87

Provision for bad debts

(a)

............................... 237 244 262

Write-offs, net of recoveries . . ........................... (237) (260) (259)

Balance at end of year ................................. $ 74 $ 74 $ 90

(a)

Provision for bad debts primarily includes amounts charged to expense associated with the Company’s allowance for doubtful accounts and

excludes collection expenses and the benefit from late fees billed to subscribers.

Investments

Investments in companies in which TWC has significant influence, but less than a controlling interest, are accounted

for using the equity method. Under the equity method of accounting, only TWC’s investment in and amounts due to and

from the equity investee are included in the consolidated balance sheet; only TWC’s share of the investee’s earnings

75

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)