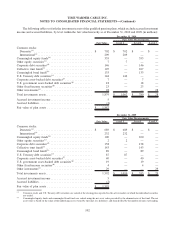

Time Warner Cable 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

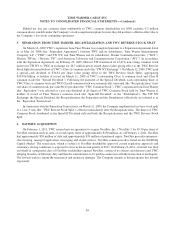

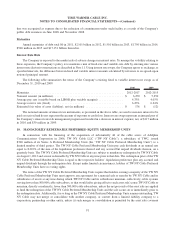

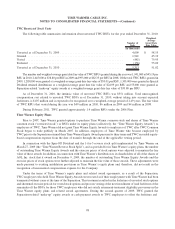

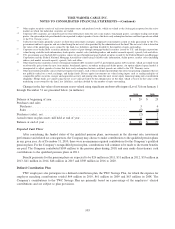

Changes in the fair value of the equity award reimbursement obligation, valued using significant unobservable inputs

(Level 3), from January 1 through December 31 are presented below (in millions):

2010 2009

Balance at beginning of year ............................................ $ 35 $ —

Establishment of equity award reimbursement obligation ....................... — 16

(Gains) losses recognized in net income ................................... (5) 21

Payments to Time Warner for awards exercised .............................. (10) (2)

Balance at end of year ................................................ $ 20 $ 35

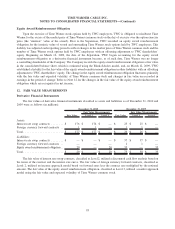

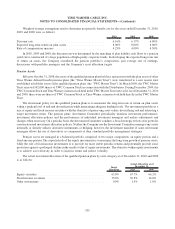

Other Financial Instruments

The Company’s other financial instruments, excluding debt subject to interest rate swap contracts, are not required to

be carried at fair value. Based on the level of interest rates prevailing at December 31, 2010 and 2009, the fair value of

TWC’s fixed-rate debt and mandatorily redeemable preferred equity exceeded the carrying value by approximately

$2.818 billion and $2.280 billion as of December 31, 2010 and 2009, respectively. Unrealized gains or losses on debt do

not result in the realization or expenditure of cash and are not recognized for financial reporting purposes unless the debt is

retired prior to its maturity. The carrying value for the majority of the Company’s other financial instruments

approximates fair value due to the short-term nature of such instruments. For the remainder of the Company’s other

financial instruments, differences between the carrying value and fair value are not significant as of December 31, 2010.

The fair value of financial instruments is generally determined by reference to the market value of the instrument as

quoted on a national securities exchange or in an over-the-counter market. In cases where a quoted market value is not

available, fair value is based on an estimate using present value or other valuation techniques.

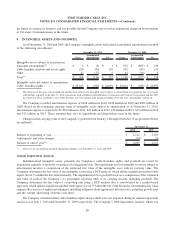

Non-Financial Instruments

The majority of the Company’s non-financial instruments, which include investments, property, plant and

equipment, intangible assets and goodwill, are not required to be carried at fair value on a recurring basis. However,

if certain triggering events occur such that a non-financial instrument is required to be evaluated for impairment, any

resulting asset impairment would require that the non-financial instrument be recorded at its fair value.

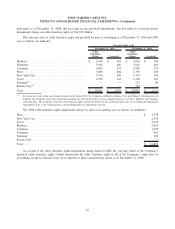

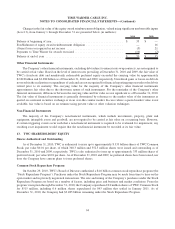

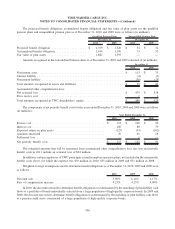

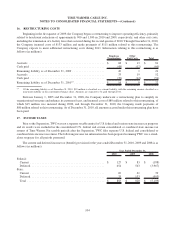

13. TWC SHAREHOLDERS’ EQUITY

Shares Authorized and Outstanding

As of December 31, 2010, TWC is authorized to issue up to approximately 8.333 billion shares of TWC Common

Stock, par value $0.01 per share, of which 348.3 million and 352.5 million shares were issued and outstanding as of

December 31, 2010 and 2009, respectively. TWC is also authorized to issue up to approximately 333 million shares of

preferred stock, par value $0.01 per share. As of December 31, 2010 and 2009, no preferred shares have been issued, nor

does the Company have current plans to issue preferred shares.

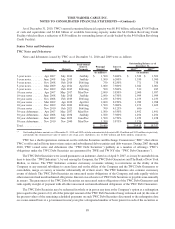

Common Stock Repurchase Program

On October 29, 2010, TWC’s Board of Directors authorized a $4.0 billion common stock repurchase program (the

“Stock Repurchase Program”). Purchases under the Stock Repurchase Program may be made from time to time on the

open market and in privately negotiated transactions. The size and timing of the Company’s purchases under the Stock

Repurchase Program are based on a number of factors, including price and business and market conditions. From the

program’s inception through December 31, 2010, the Company repurchased 8.0 million shares of TWC Common Stock

for $515 million, including 0.6 million shares repurchased for $43 million that settled in January 2011. As of

December 31, 2010, the Company had $3.485 billion remaining under the Stock Repurchase Program.

94

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)