Time Warner Cable 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152

|

|

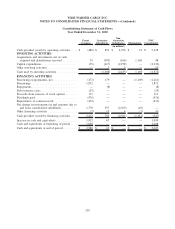

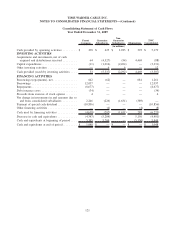

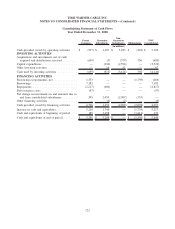

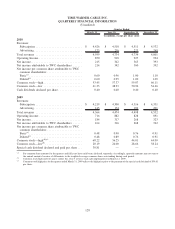

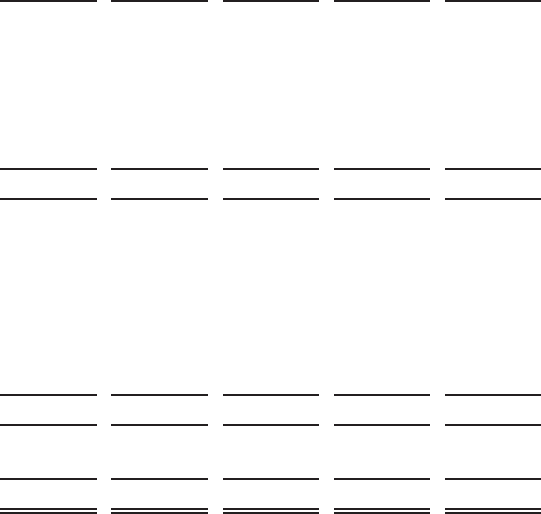

Consolidating Statement of Cash Flows

Year Ended December 31, 2008

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

(in millions)

Cash provided (used) by operating activities .... $ (927) $ 1,207 $ 5,223 $ (203) $ 5,300

INVESTING ACTIVITIES

Acquisitions and investments, net of cash

acquired and distributions received ......... (659) (3) (579) 556 (685)

Capital expenditures ...................... — (926) (2,596) — (3,522)

Other investing activities .................. — 16 51 — 67

Cash used by investing activities ............ (659) (913) (3,124) 556 (4,140)

FINANCING ACTIVITIES

Borrowings (repayments), net ............... 1,533 — — (1,739) (206)

Borrowings . ........................... 7,182 — — — 7,182

Repayments . ........................... (2,217) (600) — — (2,817)

Debt issuance costs ...................... (97) — — — (97)

Net change in investments in and amounts due to

and from consolidated subsidiaries ......... 395 2,055 (2,097) (353) —

Other financing activities .................. — (3) (2) — (5)

Cash provided (used) by financing activities .... 6,796 1,452 (2,099) (2,092) 4,057

Increase in cash and equivalents ............. 5,210 1,746 — (1,739) 5,217

Cash and equivalents at beginning of period .... 185 3,458 — (3,411) 232

Cash and equivalents at end of period ......... $ 5,395 $ 5,204 $ — $ (5,150) $ 5,449

122

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)