Time Warner Cable 2010 Annual Report Download - page 96

Download and view the complete annual report

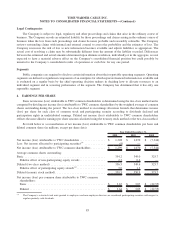

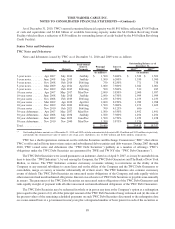

Please find page 96 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Diluted net loss per common share attributable to TWC common shareholders for 2008 excludes 0.2 million

common shares issuable under the Company’s stock compensation plans because they did not have a dilutive effect due to

the Company’s loss from continuing operations.

5. SEPARATION FROM TIME WARNER, RECAPITALIZATION AND TWC REVERSE STOCK SPLIT

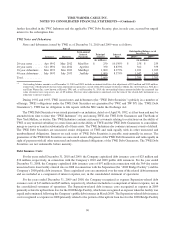

On March 12, 2009, TWC’s separation from Time Warner was completed pursuant to a Separation Agreement dated

as of May 20, 2008 (the “Separation Agreement”) between TWC and its subsidiaries, Time Warner Entertainment

Company, L.P. (“TWE”) and TW NY, and Time Warner and its subsidiaries, Warner Communications Inc. (“WCI”),

Historic TW Inc. (“Historic TW”) and American Television and Communications Corporation (“ATC”). In accordance

with the Separation Agreement, on February 25, 2009, Historic TW transferred its 12.43% non-voting common stock

interest in TW NY to TWC in exchange for 26.7 million newly issued shares (after giving effect to the TWC Reverse

Stock Split discussed below) of TWC’s Class A common stock (the “TW NY Exchange”). On March 12, 2009, TWC paid

a special cash dividend of $30.81 per share (after giving effect to the TWC Reverse Stock Split), aggregating

$10.856 billion, to holders of record on March 11, 2009 of TWC’s outstanding Class A common stock and Class B

common stock (the “Special Dividend”). Following the payment of the Special Dividend, each outstanding share of

TWC Class A common stock and TWC Class B common stock was automatically converted (the “Recapitalization”) into

one share of common stock, par value $0.01 per share (the “TWC Common Stock”). TWC’s separation from Time Warner

(the “Separation”) was effected as a pro rata dividend of all shares of TWC Common Stock held by Time Warner to

holders of record of Time Warner’s common stock (the “Spin-Off Dividend” or the “Distribution”). The TW NY

Exchange, the Special Dividend, the Recapitalization, the Separation and the Distribution collectively are referred to as

the “Separation Transactions.”

In connection with the Separation Transactions, on March 12, 2009, the Company implemented a reverse stock split

at a 1-for-3 ratio (the “TWC Reverse Stock Split”), effective immediately after the Recapitalization. The shares of TWC

Common Stock distributed in the Spin-Off Dividend reflected both the Recapitalization and the TWC Reverse Stock

Split.

6. NAVISITE ACQUISITION

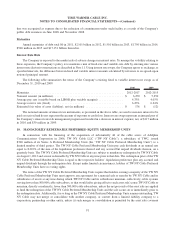

On February 1, 2011, TWC entered into an agreement to acquire NaviSite, Inc. (“NaviSite”) for $5.50 per share of

NaviSite common stock in cash, or a total equity value of approximately $230 million. As of February 1, 2011, NaviSite

had approximately $50 million of debt and approximately $35 million of preferred equity. NaviSite provides enterprise-

class hosting, managed application, messaging and cloud services. NaviSite common stock is listed on the NASDAQ

Capital Market. The transaction, which is subject to NaviSite stockholder approval, certain regulatory approvals and

customary closing conditions, is expected to close in the second quarter of 2011. On February 8, 2011, a lawsuit was filed

on behalf of a purported class of NaviSite stockholders against NaviSite, certain of its officers and directors and TWC

alleging breaches of fiduciary duty and that the consideration to be paid in connection with the transaction is inadequate.

The lawsuit seeks to enjoin the transaction and monetary damages. The Company intends to defend against this lawsuit

vigorously.

84

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)