Time Warner Cable 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

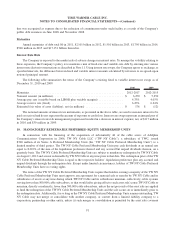

described above, (ii) if TW NY Cable is not the surviving entity or is no longer a limited liability company, the then

holders of the TW NY Cable Preferred Membership Units have the right to receive from the surviving entity securities

with terms at least as favorable as the TW NY Cable Preferred Membership Units and (iii) if TW NY Cable is the

surviving entity, the tax characterization of the TW NY Cable Preferred Membership Units would not be affected by the

merger or consolidation. Any securities received from a surviving entity as a result of a merger or consolidation or the

conversion into a corporation, partnership or other entity must rank senior to any other securities of the surviving entity

with respect to dividends and distributions or rights upon a liquidation.

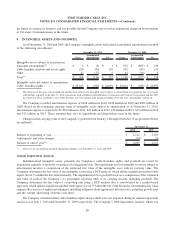

11. DERIVATIVE FINANCIAL INSTRUMENTS

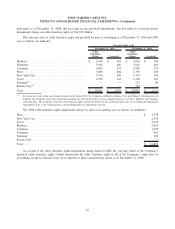

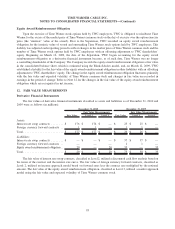

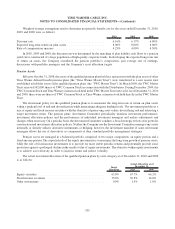

The fair values of the assets and liabilities associated with the Company’s derivative financial instruments recorded

in the consolidated balance sheet as of December 31, 2010 and 2009 were as follows (in millions):

Balance Sheet

Location 2010 2009

December 31,

Assets:

Derivatives designated as hedging instruments:

Interest rate swap contracts ........................... Other assets $ 176 $ 25

Foreign currency forward contracts . . . .................. Other current assets 1 1

Total assets ...................................... $ 177 $ 26

Liabilities:

Derivatives designated as hedging instruments:

Interest rate swap contracts ........................... Other liabilities $ — $ 37

Foreign currency forward contracts . . . .................. Other current liabilities — 1

Derivatives not designated as hedging instruments:

Equity award reimbursement obligation .................. Other current liabilities 20 35

Total liabilities . . .................................. $ 20 $ 73

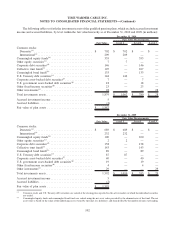

Interest Rate Swap Contracts

Interest rate swap contracts are used to change the nature of outstanding debt (e.g., convert fixed-rate debt into

variable-rate debt or convert variable-rate debt into fixed-rate debt). As of December 31, 2010, the Company had interest

rate swap contracts outstanding that effectively convert $6.250 billion of fixed-rate debt instruments, with maturities

extending through May 2017, to variable-rate debt. Such contracts are designated as fair value hedges. Under its interest

rate swap contracts, the Company is entitled to receive semi-annual fixed rates of interest ranging from 3.500% to

10.150% and is required to make semi-annual interest payments at variable rates based on LIBOR plus margins ranging

from 0.755% to 8.442%. During the years ended December 31, 2010 and 2009, the Company recognized no gain or loss

related to its interest rate swap contracts because the changes in the fair values of such instruments were completely offset

by the changes in the fair values of the hedged fixed-rate debt.

Foreign Currency Forward Contracts

Foreign currency forward contracts are used to mitigate the risk to the Company from changes in foreign currency

exchange rates. As of December 31, 2010, the Company had outstanding foreign currency forward contracts to buy

Philipine pesos for $11 million. Such contracts, which extend through May 2011, are designated as cash flow hedges and

specifically relate to forecasted payments denominated in the Philippine peso made to vendors who provide customer care

support services. For the years ended December 31, 2010 and 2009, the effects of foreign currency forward contracts on

earnings were immaterial. The Company expects insignificant net gains (losses) to be reclassified out of accumulated

other comprehensive loss, net, and into earnings within the next 12 months.

92

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)