Time Warner Cable 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

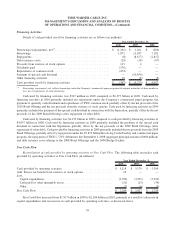

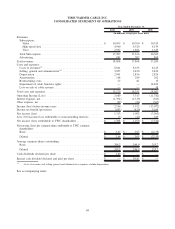

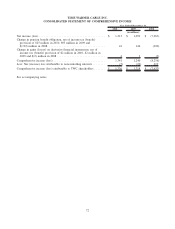

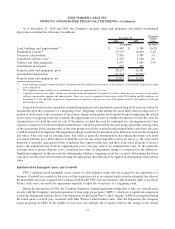

TIME WARNER CABLE INC.

CONSOLIDATED STATEMENT OF OPERATIONS

2010 2009 2008

Year Ended December 31,

(in millions, except per share data)

Revenues:

Subscription:

Video ............................................... $ 10,995 $ 10,760 $ 10,524

High-speed data . . ..................................... 4,960 4,520 4,159

Voice ............................................... 2,032 1,886 1,619

Total Subscription . . ..................................... 17,987 17,166 16,302

Advertising . . .......................................... 881 702 898

Total revenues . . .......................................... 18,868 17,868 17,200

Costs and expenses:

Costs of revenues

(a)

...................................... 8,941 8,555 8,145

Selling, general and administrative

(a)

.......................... 3,057 2,830 2,854

Depreciation . .......................................... 2,961 2,836 2,826

Amortization . .......................................... 168 249 262

Restructuring costs . . ..................................... 52 81 15

Impairment of cable franchise rights .......................... — — 14,822

Loss on sale of cable systems ............................... — — 58

Total costs and expenses..................................... 15,179 14,551 28,982

Operating Income (Loss) .................................... 3,689 3,317 (11,782)

Interest expense, net . . . ..................................... (1,394) (1,319) (923)

Other expense, net ......................................... (99) (86) (367)

Income (loss) before income taxes . . . .......................... 2,196 1,912 (13,072)

Income tax benefit (provision) ................................ (883) (820) 5,109

Net income (loss).......................................... 1,313 1,092 (7,963)

Less: Net (income) loss attributable to noncontrolling interests ......... (5) (22) 619

Net income (loss) attributable to TWC shareholders . . ............... $ 1,308 $ 1,070 $ (7,344)

Net income (loss) per common share attributable to TWC common

shareholders:

Basic . ................................................ $ 3.67 $ 3.07 $ (22.55)

Diluted ............................................... $ 3.64 $ 3.05 $ (22.55)

Average common shares outstanding:

Basic . ................................................ 354.2 349.0 325.7

Diluted ............................................... 359.5 350.9 325.7

Cash dividends declared per share .............................. $ 1.60 $ — $ —

Special cash dividend declared and paid per share . . . ............... $ — $ 30.81 $ —

(a)

Costs of revenues and selling, general and administrative expenses exclude depreciation.

See accompanying notes.

69