Time Warner Cable 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

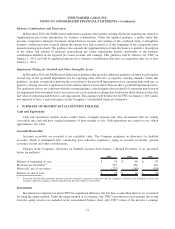

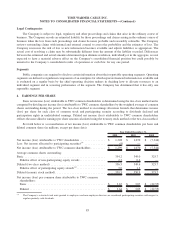

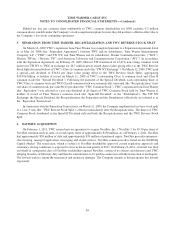

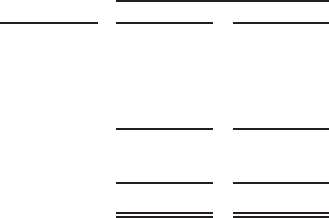

7. INVESTMENTS

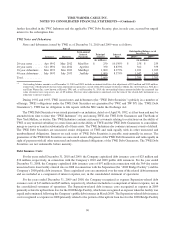

The components of the Company’s investments as of December 31, 2010 and 2009 and related ownership

percentages as of December 31, 2010 are presented in the table below (in millions):

Ownership

Percentage 2010 2009

Investment Balance as of

December 31,

Equity-method investments:

SpectrumCo ............................................ 31.2% $ 692 $ 691

Clearwire Communications.................................. 4.7% 94 207

Other .................................................. 59 53

Total equity-method investments ............................... 845 951

Other investments .......................................... 21 24

Total investments ........................................... $ 866 $ 975

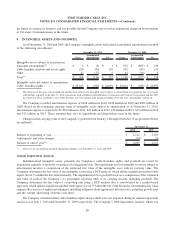

For the years ended December 31, 2010 and 2009, the Company recognized losses from equity-method investments

of $110 million and $49 million, respectively, and, for the year ended December 31, 2008, recognized income from

equity-method investments of $16 million, which is included in other expense, net, in the consolidated statement of

operations.

SpectrumCo

TWC is a participant in a joint venture with certain other cable companies (“SpectrumCo”) that holds advanced

wireless spectrum (“AWS”) licenses. TWC made net cash investments in SpectrumCo of $2 million in 2010, $29 million

in 2009 and $3 million in 2008.

Clearwire Communications

TWC holds an equity interest in Clearwire Communications LLC (“Clearwire Communications”), the operating

subsidiary of Clearwire Corporation (“Clearwire”), a publicly traded company that was formed by the combination of the

respective wireless broadband businesses of Sprint Nextel Corporation (“Sprint”) and Clearwire Communications.

Clearwire is focused on deploying a nationwide fourth-generation (“4G”) wireless network to provide mobile broadband

services to wholesale and retail customers. In connection with TWC’s initial investment in Clearwire Communications,

TWC entered into wholesale agreements with Clearwire and Sprint that allow TWC to offer wireless services utilizing

Clearwire’s 4G WiMax network and Sprint’s third-generation code division multiple access (“CDMA”) network. TWC

made net cash investments in Clearwire Communications of $4 million in 2010, $97 million in 2009 and $536 million in

2008.

During 2008, the Company recorded a noncash pretax impairment charge of $367 million on its investment in

Clearwire Communications as a result of a significant decline in the estimated fair value of the investment, which is

included in other expense, net, in the consolidated statement of operations. The primary input in estimating the fair value

of TWC’s investment in Clearwire Communications was the quoted market value of Clearwire’s publicly traded shares of

Class A common stock at December 31, 2008, which declined significantly from May 2008, the date TWC agreed to make

its initial investment.

As of December 31, 2010, the Company’s equity interest in the underlying net assets of Clearwire Communications

exceeded the carrying value of the Company’s investment by approximately $200 million. Such difference relates to

intangible assets not subject to amortization and, therefore, is not being amortized.

In its Quarterly Report on Form 10-Q for the quarter ended September 30, 2010, Clearwire disclosed that it may not

be able to continue to operate as a going concern. Subsequently, in December 2010, Clearwire raised $1.404 billion in a

private placement of debt securities. There can be no assurance that Clearwire will be able to obtain sufficient financing in

85

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)