Time Warner Cable 2010 Annual Report Download - page 93

Download and view the complete annual report

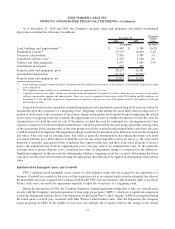

Please find page 93 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.hedge of the exposure to changes in the fair value of a recognized asset or liability or an unrecognized firm commitment (a

“fair value hedge”) or (b) a hedge of the exposure to variable cash flows of a forecasted transaction or a hedge of the

foreign currency exposure of a forecasted transaction denominated in a foreign currency (a “cash flow hedge”). For a

derivative financial instrument designated as a fair value hedge, the gain or loss on the derivative financial instrument is

recognized in earnings in the period of change together with the offsetting loss or gain on the hedged item attributable to

the risk being hedged. As a result, the consolidated statement of operations includes the impact of changes in the fair value

of both the derivative financial instrument and the hedged item, which reflects in earnings the extent to which the hedge is

ineffective in achieving offsetting changes in fair value. For a derivative financial instrument designated as a cash flow

hedge, the effective portion of the gain or loss on the derivative financial instrument is initially reported in equity as a

component of accumulated other comprehensive income (loss), net, and subsequently reclassified into earnings when the

hedged item (e.g., a forecasted transaction denominated in a foreign currency) affects earnings. The ineffective portion of

the gain or loss is reported in earnings immediately. For a derivative financial instrument not designated as a hedging

instrument, the gain or loss is recognized in earnings in the period of change. The Company uses derivative financial

instruments primarily to manage the risks associated with fluctuations in interest rates and foreign currency exchange

rates and does not hold or issue derivative financial instruments for speculative or trading purposes.

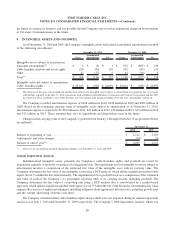

Fair Value Measurements

The fair value of an asset or liability is based on the assumptions that market participants would use in pricing the

asset or liability. Valuation techniques consistent with the market approach, income approach and/or cost approach are

used to measure fair value. The Company follows a three-tiered fair value hierarchy when determining the inputs to

valuation techniques. The fair value hierarchy prioritizes the inputs to valuation techniques into three broad levels in order

to maximize the use of observable inputs and minimize the use of unobservable inputs. The levels of the fair value

hierarchy are as follows:

• Level 1: consists of financial instruments whose values are based on quoted market prices for identical

financial instruments in an active market.

• Level 2: consists of financial instruments whose values are determined using models or other valuation

methodologies that utilize inputs that are observable either directly or indirectly, including (i) quoted prices

for similar assets or liabilities in active markets, (ii) quoted prices for identical or similar assets or liabilities in

markets that are not active, (iii) pricing models whose inputs are observable for substantially the full term of the

financial instrument and (iv) pricing models whose inputs are derived principally from or corroborated by

observable market data through correlation or other means for substantially the full term of the financial

instrument.

• Level 3: consists of financial instruments whose values are determined using pricing models that utilize

significant inputs that are primarily unobservable, discounted cash flow methodologies, or similar techniques,

as well as instruments for which the determination of fair value requires significant management judgment or

estimation.

Accounting for Pension Plans

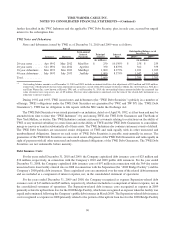

TWC sponsors qualified noncontributory defined benefit pension plans covering a majority of its employees. TWC also

provides a nonqualified noncontributory defined benefit pension plan for certain employees. Pension benefits are based on

formulas that reflect the employees’ years of service and compensation during their employment period. The pension

expense recognized by the Company is determined using certain assumptions, including the expected long-term rate of

return on plan assets, the interest factor implied by the discount rate and the expected rate of compensation increases.

Income Taxes

Prior to the Separation, TWC was not a separate taxable entity for U.S. federal and various state income tax purposes

and its results were included in the consolidated U.S. federal and certain state income tax returns of Time Warner. The

81

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)