Time Warner Cable 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

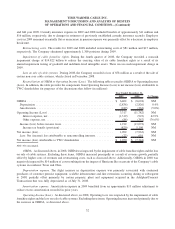

Interest expense, net. Interest expense, net, increased primarily due to higher average debt outstanding during 2009.

Additionally, interest expense, net, for 2009 included $13 million of debt issuance costs primarily related to upfront loan

fees on the 2008 Bridge Facility, which were recognized as expense when the facility was repaid and terminated following

the Company’s public debt issuance in March 2009. Interest expense, net, for 2008 included $45 million of debt issuance

costs primarily related to the portion of the upfront loan fees for the 2008 Bridge Facility that was recognized as expense

due to the reduction of commitments under such facility as a result of the Company’s public debt issuances in June 2008

and November 2008 (the “2008 Bond Offerings”).

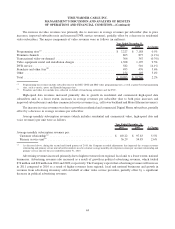

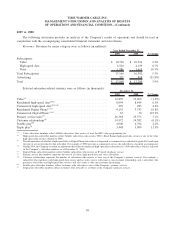

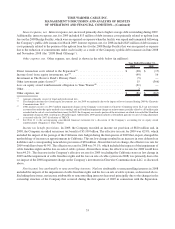

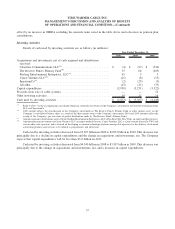

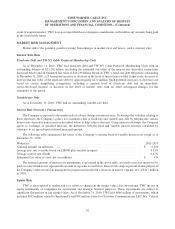

Other expense, net. Other expense, net, detail is shown in the table below (in millions):

2009 2008

Year Ended December 31,

Direct transaction costs related to the Separation

(a)

............................ $ (28) $ (17)

Income (loss) from equity investments, net

(b)

................................ (49) 16

Investment in The Reserve Fund’s Primary Fund ............................. (5) —

Other investment gains (losses)

(c)

........................................ 15 (366)

Loss on equity award reimbursement obligation to Time Warner

(d)

................ (21) —

Other ............................................................. 2 —

Other expense, net ................................................... $ (86) $ (367)

(a)

Amounts primarily consist of legal and professional fees.

(b)

The change in income (loss) from equity investments, net, for 2009 was primarily due to the impact of losses incurred during 2009 by Clearwire

Communications LLC.

(c)

2008 amount consists of a $367 million impairment charge on the Company’s investment in Clearwire Communications LLC (an investment

accounted for under the equity method of accounting) and an $8 million impairment charge on an investment, partially offset by a $9 million gain

recorded on the sale of a cost-method investment. In 2009, the Company recovered a portion of the investment on which it recorded the $8 million

impairment charge in 2008, resulting in a $3 million gain. Additionally, 2009 amount includes a $12 million gain due to a post-closing adjustment

associated with the 2007 dissolution of TKCCP.

(d)

See Note 11 to the accompanying consolidated financial statements for a discussion of the Company’s accounting for its equity award

reimbursement obligation to Time Warner.

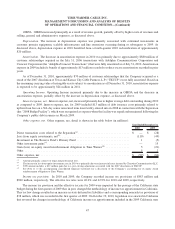

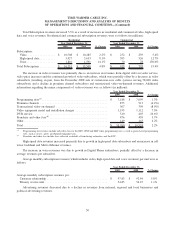

Income tax benefit (provision). In 2009, the Company recorded an income tax provision of $820 million and, in

2008, the Company recorded an income tax benefit of $5.109 billion. The effective tax rate for 2009 was 42.9%, which

included the impact of the passage of the California state budget during the first quarter of 2009 that, in part, changed the

methodology of income tax apportionment in California. This tax law change resulted in an increase in state deferred tax

liabilities and a corresponding noncash tax provision of $38 million. Absent this tax law change, the effective tax rate for

2009 would have been 40.9%. The effective tax rate for 2008 was 39.1%, which included the impacts of the impairment of

cable franchise rights and the loss on sale of cable systems. Absent these items, the effective tax rate for 2008 would have

been 44.2%. The decrease in the Company’s effective tax rate for 2009 (excluding the California state tax law change in

2009 and the impairment of cable franchise rights and the loss on sale of cable systems in 2008) was primarily due to the

tax impact of the 2008 impairment charge on the Company’s investment in Clearwire Communications LLC, as discussed

above.

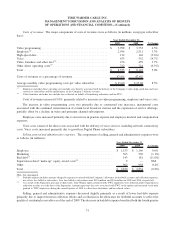

Net (income) loss attributable to noncontrolling interests. Net loss attributable to noncontrolling interests in 2008

included the impacts of the impairment of cable franchise rights and the loss on sale of cable systems, as discussed above.

Excluding these items, net income attributable to noncontrolling interests decreased principally due to the changes in the

ownership structure of the Company that occurred during the first quarter of 2009 in connection with the Separation.

53

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)