Time Warner Cable 2010 Annual Report Download - page 77

Download and view the complete annual report

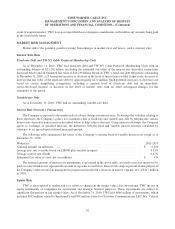

Please find page 77 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.disclosed that it may not be able to continue to operate as a going concern. Subsequently, in December 2010, Clearwire

raised $1.404 billion in a private placement of debt securities. There can be no assurance that Clearwire will be able to

obtain sufficient financing in the future to continue its business, and it is possible that the Company may record an

impairment charge on its investment in Clearwire Communications LLC in the future.

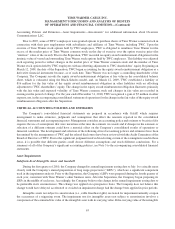

Long-lived Assets

Long-lived assets (e.g., property, plant and equipment and intangible assets subject to amortization) do not require

that an annual impairment test be performed; instead, long-lived assets are tested for impairment upon the occurrence of a

triggering event. Triggering events include the more likely than not disposal of a portion of such assets or the occurrence

of an adverse change in the market involving the business employing the related assets. Once a triggering event has

occurred, the impairment test is based on whether the intent is to hold the asset for continued use or to hold the asset for

sale. If the intent is to hold the asset for continued use, the impairment test first requires a comparison of estimated

undiscounted future cash flows generated by the asset group against the carrying value of the asset group. If the carrying

value of the asset group exceeds the estimated undiscounted future cash flows, the asset would be deemed to be impaired.

The impairment charge would then be measured as the difference between the estimated fair value of the asset and its

carrying value. Fair value is generally determined by discounting the future cash flows associated with that asset. If the

intent is to hold the asset for sale and certain other criteria are met (e.g., the asset can be disposed of currently, appropriate

levels of authority have approved the sale, and there is an active program to locate a buyer), the impairment test involves

comparing the asset’s carrying value to its estimated fair value. To the extent the carrying value is greater than the asset’s

estimated fair value, an impairment charge is recognized for the difference. Significant judgments in this area involve

determining whether a triggering event has occurred, determining the future cash flows for the assets involved and

selecting the appropriate discount rate to be applied in determining estimated fair value. In 2010, there were no significant

long-lived asset impairment charges.

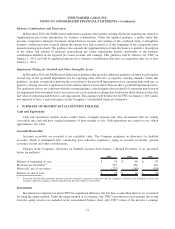

Income Taxes

From time to time, the Company engages in transactions in which the tax consequences may be subject to

uncertainty. Examples of such transactions include business acquisitions and dispositions, including dispositions

designed to be tax free, issues related to consideration paid or received, and certain financing transactions.

Significant judgment is required in assessing and estimating the tax consequences of these transactions. The

Company prepares and files tax returns based on interpretation of tax laws and regulations. In the normal course of

business, the Company’s tax returns are subject to examination by various taxing authorities. Such examinations may

result in future tax and interest assessments by these taxing authorities. In determining the Company’s tax provision for

financial reporting purposes, the Company establishes a reserve for uncertain income tax positions unless such positions

are determined to be more likely than not of being sustained upon examination, based on their technical merits. That is, for

financial reporting purposes, the Company only recognizes tax benefits taken on the tax return that it believes are more

likely than not of being sustained. There is considerable judgment involved in determining whether positions taken on the

tax return are more likely than not of being sustained.

The Company adjusts its tax reserve estimates periodically because of ongoing examinations by, and settlements

with, the various taxing authorities, as well as changes in tax laws, regulations and interpretations. The consolidated tax

provision of any given year includes adjustments to prior year income tax accruals that are considered appropriate and any

related estimated interest. The Company’s policy is to recognize, when applicable, interest and penalties on uncertain

income tax positions as part of income tax expense. Refer to Note 17 to the accompanying consolidated financial

statements for further details.

Legal Contingencies

The Company is subject to legal, regulatory and other proceedings and claims that arise in the ordinary course of

business. The Company records an estimated liability for those proceedings and claims arising in the ordinary course of

65

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)