Time Warner Cable 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the future to continue its business, and it is possible that the Company may record an impairment charge on its investment

in Clearwire Communications in the future.

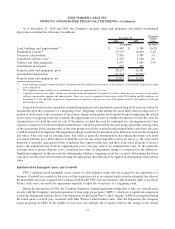

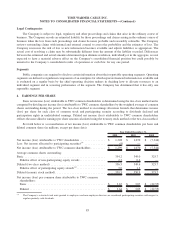

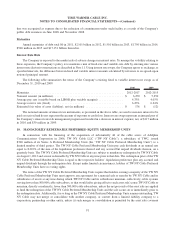

8. INTANGIBLE ASSETS AND GOODWILL

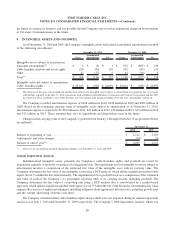

As of December 31, 2010 and 2009, the Company’s intangible assets and related accumulated amortization consisted

of the following (in millions):

Gross

Accumulated

Amortization Net Gross

Accumulated

Amortization Net

December 31, 2010 December 31, 2009

Intangible assets subject to amortization:

Customer relationships

(a)

.............. $ 6 $ (5) $ 1 $ 952 $ (803) $ 149

Cable franchise renewals and access rights . . . 220 (94) 126 202 (83) 119

Other ............................ 42 (37) 5 42 (36) 6

Total

(a)

........................... $ 268 $ (136) $ 132 $ 1,196 $ (922) $ 274

Intangible assets not subject to amortization:

Cable franchise rights ................ $ 25,013 $ (922) $ 24,091 $ 25,014 $ (922) $ 24,092

(a)

The decrease in the gross and accumulated amortization balances for intangible assets subject to amortization was primarily due to customer

relationships acquired in the July 31, 2006 transactions with Adelphia Communications Corporation and Comcast Corporation and the 2007

dissolution of Texas and Kansas City Cable Partners, L.P. that became fully amortized during 2010 and were subsequently written off.

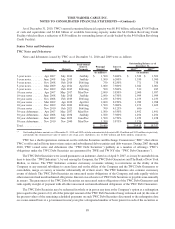

The Company recorded amortization expense of $168 million in 2010, $249 million in 2009 and $262 million in

2008. Based on the remaining carrying value of intangible assets subject to amortization as of December 31, 2010,

amortization expense is expected to be $24 million in 2011, $22 million in 2012, $18 million in 2013, $15 million in 2014

and $12 million in 2015. These amounts may vary as acquisitions and dispositions occur in the future.

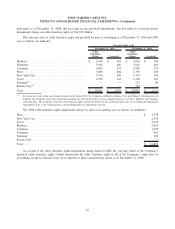

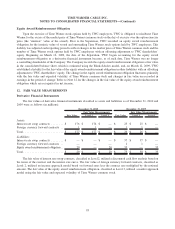

Changes in the carrying value of the Company’s goodwill from January 1 through December 31 are presented below

(in millions):

2010 2009

December 31,

Balance at beginning of year ............................................ $ 2,111 $ 2,101

Adjustments and other changes .......................................... (20) 10

Balance at end of year

(a)

............................................... $ 2,091 $ 2,111

(a)

There are no accumulated goodwill impairment charges as of December 31, 2010 and 2009.

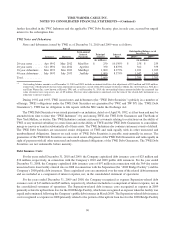

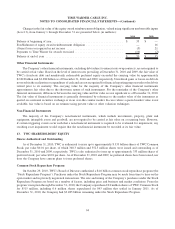

Annual Impairment Analysis

Indefinite-lived intangible assets, primarily the Company’s cable franchise rights, and goodwill are tested for

impairment annually or upon the occurrence of a triggering event. The impairment test for intangible assets not subject to

amortization involves a comparison of the estimated fair value of the intangible asset with its carrying value. The

Company determines the fair value of the intangible asset using a DCF analysis, which utilizes significant unobservable

inputs (Level 3) within the fair value hierarchy. The impairment test for goodwill involves a comparison of the estimated

fair value of each of the Company’s six geographic reporting units to its carrying amount, including goodwill. The

Company determines the fair value of a reporting unit using a DCF analysis that is corroborated by a market-based

approach, which utilizes significant unobservable inputs (Level 3) within the fair value hierarchy. Determining fair value

requires the exercise of significant judgment, including judgment about appropriate discount rates, perpetual growth rates

and the amount and timing of future cash flows.

The Company determined that cable franchise rights and goodwill were not impaired during its annual impairment

analyses as of July 1, 2010 and December 31, 2009 respectively. The Company’s 2008 impairment analysis, which was

86

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)