Time Warner Cable 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Equity Award Reimbursement Obligation

Upon the exercise of Time Warner stock options held by TWC employees, TWC is obligated to reimburse Time

Warner for the excess of the market price of Time Warner common stock on the day of exercise over the option exercise

price (the “intrinsic” value of the award). Prior to the Separation, TWC recorded an equity award reimbursement

obligation for the intrinsic value of vested and outstanding Time Warner stock options held by TWC employees. This

liability was adjusted each reporting period to reflect changes in the market price of Time Warner common stock and the

number of Time Warner stock options held by TWC employees with an offsetting adjustment to TWC shareholders’

equity. Beginning on March 12, 2009, the date of the Separation, TWC began accounting for the equity award

reimbursement obligation as a derivative financial instrument because, as of such date, Time Warner was no longer

a controlling shareholder of the Company. The Company records the equity award reimbursement obligation at fair value

in the consolidated balance sheet, which is estimated using the Black-Scholes model, and, on March 12, 2009, TWC

established a liability for the fair value of the equity award reimbursement obligation in other liabilities with an offsetting

adjustment to TWC shareholders’ equity. The change in the equity award reimbursement obligation fluctuates primarily

with the fair value and expected volatility of Time Warner common stock and changes in fair value are recorded in

earnings in the period of change. Refer to Note 12 for the changes in the fair value of the equity award reimbursement

obligation which are recognized in net income.

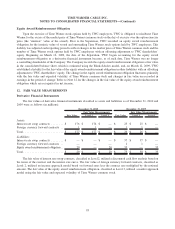

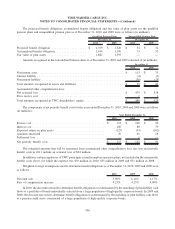

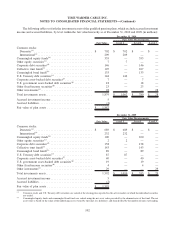

12. FAIR VALUE MEASUREMENTS

Derivative Financial Instruments

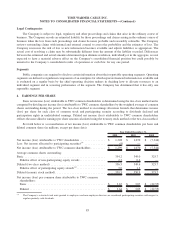

The fair values of derivative financial instruments classified as assets and liabilities as of December 31, 2010 and

2009 were as follows (in millions):

Fair Value Level 2 Level 3 Fair Value Level 2 Level 3

Fair Value Measurements Fair Value Measurements

December 31, 2010 December 31, 2009

Assets:

Interest rate swap contracts ........ $ 176 $ 176 $ — $ 25 $ 25 $ —

Foreign currency forward contracts . . 1 1 — 1 1 —

Total ......................... $ 177 $ 177 $ — $ 26 $ 26 $ —

Liabilities:

Interest rate swap contracts ........ $ — $ — $ — $ 37 $ 37 $ —

Foreign currency forward contracts . . — — — 1 1 —

Equity award reimbursement obligation . . 20 — 20 35 — 35

Total ......................... $ 20 $ — $ 20 $ 73 $ 38 $ 35

The fair value of interest rate swap contracts, classified as Level 2, utilized a discounted cash flow analysis based on

the terms of the contract and the interest rate curve. The fair value of foreign currency forward contracts, classified as

Level 2, utilized an income approach model based on forward rates less the contract rate multiplied by the notional

amount. The fair value of the equity award reimbursement obligation, classified as Level 3, utilized a market approach

model using the fair value and expected volatility of Time Warner common stock.

93

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)