Time Warner Cable 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

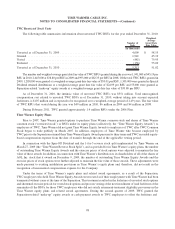

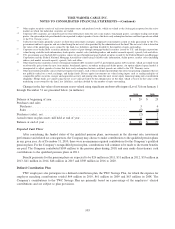

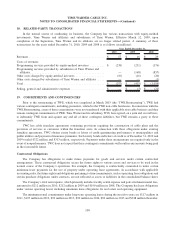

The differences between income tax (benefit) provision expected at the U.S. federal statutory income tax rate of 35%

and income tax (benefit) provision provided for the years ended December 31, 2010, 2009 and 2008 are as follows (in

millions):

2010 2009 2008

Year Ended December 31,

Tax (benefit) provision on income at U.S. federal statutory rate ....... $ 769 $ 669 $ (4,575)

State and local taxes (tax benefits), net of federal tax effects ......... 66 126 (620)

Equity-based compensation ................................. 61 1 —

Other. . . ............................................... (13) 24 86

Total . . . ............................................... $ 883 $ 820 $ (5,109)

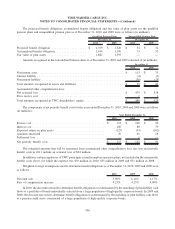

The income tax provision and the effective tax rate for the year ended December 31, 2010 were impacted by a net

noncash charge of $68 million ($61 million and $7 million for federal and state taxes, respectively) related to the reversal

of previously recognized deferred income tax benefits primarily as a result of the expiration, on March 12, 2010, of vested

Time Warner stock options held by TWC employees. As a result of the Separation on March 12, 2009, TWC employees

who held stock options under Time Warner equity plans were treated as if their employment with Time Warner had been

terminated without cause at the time of the Separation. In most cases, this treatment resulted in shortened exercise periods,

generally one year from the date of Separation, for vested Time Warner stock options held by TWC employees. Vested

Time Warner stock options held primarily by certain retirement-eligible TWC employees (pursuant to the terms of the

award agreements) have exercise periods of up to five years from the date of the Separation. As such, the Company

estimates that it may incur additional noncash income tax expense of up to approximately $90 million through March

2014 upon the exercise or expiration of these stock options. Up to approximately $50 million of such expense is expected

to be incurred in the first quarter of 2011 and may be partially reduced during 2011 as TWC equity awards vest and are

exercised. These estimates and the timing of such charges are dependent on a number of variables related to TWC and

Time Warner equity awards, including the respective stock prices and the timing of the exercise or expiration of stock

options and RSUs.

105

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)