Time Warner Cable 2010 Annual Report Download - page 50

Download and view the complete annual report

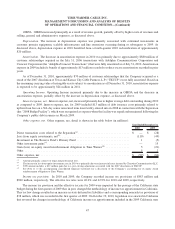

Please find page 50 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Video generates the largest share of TWC’s revenues and, as of December 31, 2010, TWC had approximately

12.3 million residential video subscribers and 165,000 commercial video subscribers. Of the Company’s video

subscribers, as of December 31, 2010, 72.1% received digital video signals. As of December 31, 2010, TWC had

approximately 9.5 million residential high-speed data subscribers and 334,000 commercial high-speed data subscribers.

TWC’s commercial high-speed data services include high-speed data, networking and transport services. As of

December 31, 2010, TWC had approximately 4.4 million residential Digital Phone subscribers and

111,000 commercial Digital Phone subscribers.

TWC believes it will continue to increase video, high-speed data and Digital Phone revenues for the foreseeable

future through the offering of incremental video services (e.g., digital video recorder (“DVR”) service and additional

programming tiers), video equipment rentals, price increases and growth in high-speed data and Digital Phone

subscribers. However, future growth rates will depend on subscriber and penetration levels, regulation, pricing and

the rate of wireless substitution of wireline high-speed data and Digital Phone services, as well as the state of the economy

and competition.

TWC’s business is affected by the economic environment and, in particular, trends in new home formation, housing

vacancy rates, unemployment rates and consumer spending levels. The Company believes that the challenging economic

environment since 2008 has negatively affected its financial and subscriber growth.

TWC faces intense competition for customers from a variety of alternative communications, information and

entertainment delivery sources. TWC competes with incumbent local telephone companies, including AT&T Inc. and

Verizon Communications Inc., across each of its primary services. Some of these telephone companies offer a broad range

of services with features and functions comparable to those provided by TWC and in bundles similar to those offered by

TWC, sometimes including wireless service. Each of TWC’s services also faces competition from other companies that

provide services on a stand-alone basis. TWC’s video service faces competition from direct broadcast satellite services,

and increasingly from companies that deliver content to consumers over the Internet. TWC’s high-speed data service

faces competition from wireless data providers, and competition in voice service is increasing as more homes in the

U.S. are replacing their wireline telephone service with wireless service or “over-the-top” phone service. Additionally,

technological advances and product innovations have increased and will likely continue to increase the number of

alternatives available to TWC’s customers and potential customers, further intensifying competition. The Company

believes the more competitive environment has negatively affected the growth of primary service units and average

monthly subscription revenues per primary service unit.

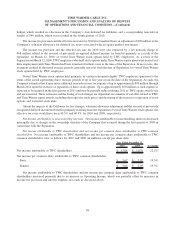

In 2010, video programming costs and employee costs represented 35.1% and 32.2%, respectively, of the Company’s

total operating expenses. Video programming costs are expected to continue to increase, reflecting rate increases on

existing programming services, costs associated with retransmission consent agreements, growth in video subscribers

taking tiers of service with more channels and the expansion of service offerings (e.g., new network channels). TWC

expects that its video programming costs as a percentage of video revenues will continue to increase as the rate of growth

in programming costs outpace the rate of growth in video revenues. Additionally, the more competitive environment

discussed above may increase TWC’s cost to obtain certain video programming. Employee costs are also expected to

continue to increase as a result of many factors, including higher employee medical and compensation expenses and the

Company’s investment in its commercial services and other areas of growth.

TWC continues to introduce innovative new services to its customers. In the fourth quarter of 2009, TWC began

offering a wireless mobile broadband Internet access service in several cities, and, as of December 31, 2010, the Company

had 13,000 wireless mobile broadband subscribers. During 2011, the Company expects to invest in other new services,

such as an advanced home security service. The Company incurred start up losses of approximately $50 million during

2010 related to wireless mobile broadband Internet access service and expects to incur start up losses of approximately

$75 million during 2011 in connection with the continued deployment of wireless mobile broadband Internet access

service and its investments in advanced home security service and other new services.

38

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)