Time Warner Cable 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

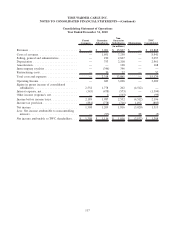

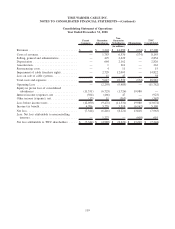

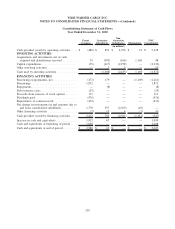

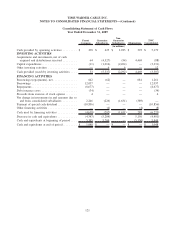

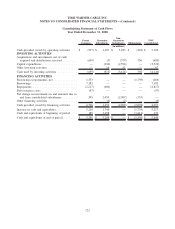

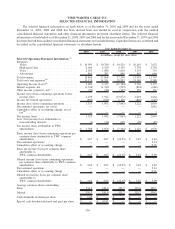

TIME WARNER CABLE INC.

SELECTED FINANCIAL INFORMATION—(Continued)

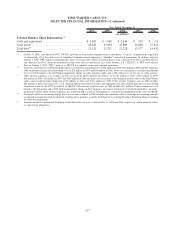

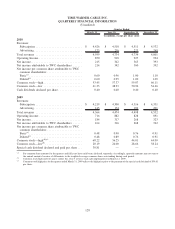

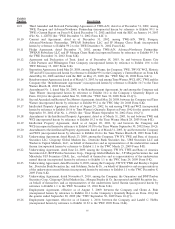

2010 2009 2008 2007 2006

Year Ended December 31,

(in millions)

Selected Balance Sheet Information:

(a)

Cash and equivalents ......................... $ 3,047 $ 1,048 $ 5,449 $ 232 $ 51

Total assets ................................ 45,822 43,694 47,889 56,600 55,821

Total debt

(e)

............................... 23,121 22,331 17,728 13,577 14,432

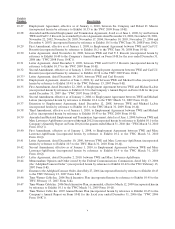

(a)

On July 31, 2006, a subsidiary of TWC, TW NY, and Comcast Corporation (together with its subsidiaries, “Comcast”) completed the acquisition

of substantially all of the cable assets of Adelphia Communications Corporation (“Adelphia”) and related transactions. In addition, effective

January 1, 2007, TWC began consolidating the results of certain cable systems located in Kansas City, south and west Texas and New Mexico

(the “Kansas City Pool”) upon the distribution of the assets of Texas and Kansas City Cable Partners, L.P. (“TKCCP”) to TWC and Comcast.

Prior to January 1, 2007, TWC’s interest in TKCCP was reported as an equity-method investment.

(b)

Total costs and expenses and Operating Income (Loss) include restructuring costs of $52 million in 2010, $81 million in 2009 and $15 million in

2008 and merger-related and restructuring costs of $23 million in 2007 and $56 million in 2006. Total costs and expenses and Operating Income

(Loss) in 2008 includes a $14.822 billion impairment charge on cable franchise rights and a $58 million loss on the sale of cable systems.

(c)

Other income (expense), net, includes income (losses) from equity-method investments of $(110) million in 2010, $(49) million in 2009,

$16 million in 2008, $11 million in 2007 and $129 million in 2006 and gains (losses) related to the change in the fair value of the Time Warner

equity award reimbursement obligation of $5 million in 2010 and $(21) million in 2009. Other income (expense), net, in 2009 includes

$28 million of direct transaction costs (e.g., legal and professional fees) related to the Separation and a $12 million gain due to a post-closing

adjustment related to the 2007 dissolution of TKCCP. Other income (expense), net, in 2008 includes $17 million of direct transaction costs

related to the Separation and a $367 million impairment charge on the Company’s investment in Clearwire Communications LLC, an equity-

method investment. Other income (expense), net, in 2007 includes a gain of $146 million as a result of the distribution of the assets of TKCCP.

(d)

Cumulative effect of accounting change, net of tax, includes a benefit in 2006 related to the cumulative effect of a change in accounting principle

recognized in connection with the adoption of authoritative guidance issued by the Financial Accounting Standards Board regarding accounting

for share-based payments.

(e)

Amounts include $1 million and $4 million of debt due within one year as of December 31, 2008 and 2006, respectively, which primarily relates

to capital lease obligations.

127