Time Warner Cable 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

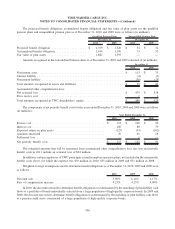

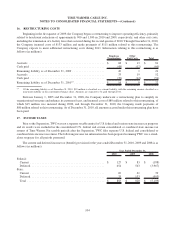

Weighted-average assumptions used to determine net periodic benefit cost for the years ended December 31, 2010,

2009 and 2008 were as follows:

2010 2009 2008

Discount rate ............................................ 6.16% 6.17% 6.00%

Expected long-term return on plan assets ....................... 8.00% 8.00% 8.00%

Rate of compensation increase ............................... 4.25% 4.00% 4.50%

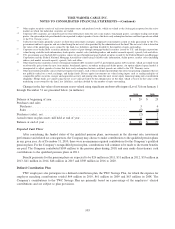

In 2010, 2009 and 2008, the discount rate was determined by the matching of plan liability cash flows to a pension

yield curve constructed of a large population of high-quality corporate bonds. In developing the expected long-term rate

of return on assets, the Company considered the pension portfolio’s composition, past average rate of earnings,

discussions with portfolio managers and the Company’s asset allocation targets.

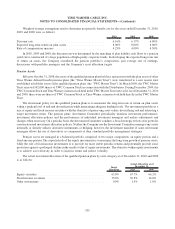

Pension Assets

Effective October 31, 2008, the assets of the qualified pension plans held in a master trust with the plan assets of other

Time Warner defined benefit pension plans (the “Time Warner Master Trust”) were transferred to a new master trust

established to hold the assets of the qualified pension plans (the “TWC Master Trust”). In March 2009, the TWC Master

Trust received 142,000 shares of TWC Common Stock in connection with the Distribution. During December 2009, the

TWC Common Stock and Time Warner common stock held in the TWC Master Trust were sold. As of December 31, 2010

and 2009, there were no shares of TWC Common Stock or Time Warner common stock held directly in the TWC Master

Trust.

The investment policy for the qualified pension plans is to maximize the long-term rate of return on plan assets

within a prudent level of risk and diversification while maintaining adequate funding levels. The investment portfolio is a

mix of equity and fixed-income securities with the objective of preserving asset values, diversifying risk and achieving a

target investment return. The pension plans’ Investment Committee periodically monitors investment performance,

investment allocation policies and the performance of individual investment managers and makes adjustments and

changes when necessary. On a periodic basis, the Investment Committee conducts a broad strategic review of its portfolio

construction and investment allocation policies. Neither the Company nor the Investment Committee manages any assets

internally or directly utilizes derivative instruments or hedging; however, the investment mandate of some investment

managers allows the use of derivatives as components of their standard portfolio management strategies.

Pension assets are managed in a balanced portfolio comprised of two major components: an equity portion and a

fixed-income portion. The expected role of the equity investments is to maximize the long-term growth of pension assets,

while the role of fixed-income investments is to provide for more stable periodic returns and potentially provide some

protection against a prolonged decline in the market value of equity investments. The objective within equity investments

is to achieve asset diversity in order to increase return and reduce volatility.

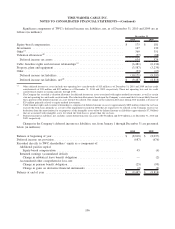

The actual investment allocation of the qualified pension plans by asset category as of December 31, 2010 and 2009

is as follows:

Target

Allocation 2010 2009

Actual Allocation as of

December 31,

Equity securities ......................................... 65.0% 67.7% 64.2%

Fixed-income securities .................................... 35.0% 30.8% 34.0%

Other investments ........................................ 0.0% 1.5% 1.8%

101

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)