Time Warner Cable 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

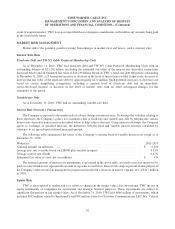

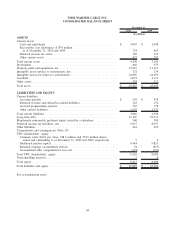

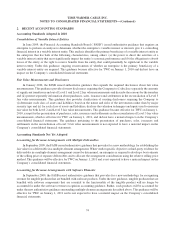

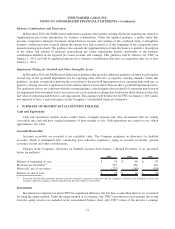

TIME WARNER CABLE INC.

CONSOLIDATED BALANCE SHEET

2010 2009

December 31,

(in millions)

ASSETS

Current assets:

Cash and equivalents ............................................ $ 3,047 $ 1,048

Receivables, less allowances of $74 million

as of December 31, 2010 and 2009 ................................ 718 663

Deferred income tax assets ........................................ 150 139

Other current assets ............................................. 425 252

Total current assets ............................................... 4,340 2,102

Investments ..................................................... 866 975

Property, plant and equipment, net .................................... 13,873 13,919

Intangible assets subject to amortization, net ............................. 132 274

Intangible assets not subject to amortization ............................. 24,091 24,092

Goodwill ....................................................... 2,091 2,111

Other assets ..................................................... 429 221

Total assets ..................................................... $ 45,822 $ 43,694

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable ............................................... $ 529 $ 478

Deferred revenue and subscriber-related liabilities ....................... 163 170

Accrued programming expense ..................................... 765 738

Other current liabilities ........................................... 1,629 1,572

Total current liabilities ............................................. 3,086 2,958

Long-term debt .................................................. 23,121 22,331

Mandatorily redeemable preferred equity issued by a subsidiary .............. 300 300

Deferred income tax liabilities, net .................................... 9,637 8,957

Other liabilities .................................................. 461 459

Commitments and contingencies (Note 19)

TWC shareholders’ equity:

Common stock, $0.01 par value, 348.3 million and 352.5 million shares

issued and outstanding as of December 31, 2010 and 2009, respectively ..... 3 4

Additional paid-in capital ......................................... 9,444 9,813

Retained earnings (accumulated deficit) .............................. 54 (813)

Accumulated other comprehensive loss, net ............................ (291) (319)

Total TWC shareholders’ equity ...................................... 9,210 8,685

Noncontrolling interests ............................................ 7 4

Total equity ..................................................... 9,217 8,689

Total liabilities and equity .......................................... $ 45,822 $ 43,694

See accompanying notes.

68