OfficeMax 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

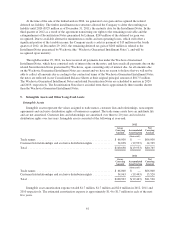

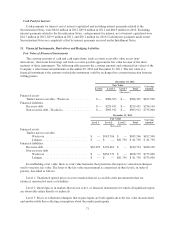

The changes in the intangible carrying amounts were as follows:

Trade names

Customer

lists/relationships

and exclusive

distribution rights Total

(thousands)

Net carrying amount, December 26, 2009........................ $66,000 $17,806 $83,806

Amortization .............................................. — (1,955) (1,955)

Effect of foreign currency translation ........................... — 1,380 1,380

Net carrying amount, December 25, 2010........................ $66,000 $17,231 $83,231

Amortization .............................................. — (1,686) (1,686)

Effect of foreign currency translation ........................... — (25) (25)

Net carrying amount, December 31, 2011........................ $66,000 $15,520 $81,520

Amortization .............................................. — (1,665) (1,665)

Effect of foreign currency translation ........................... — 910 910

Net carrying amount, December 29, 2012........................ $66,000 $14,765 $80,765

Our trade name assets are intangible assets with indefinite lives. They are not amortized, but are tested for

impairment at least annually or more frequently if events and circumstances indicate that the asset might be

impaired. Beginning in 2012, we may make a qualitative assessment to determine whether it is more likely than

not that an indefinite-lived intangible asset, other than goodwill, is impaired. If, after making the qualitative

assessment, we determine it is not more likely than not that the fair value of an indefinite-lived intangible asset is

less than its carrying amount, then performing a quantitative impairment test is unnecessary. If a quantitative

impairment test is performed, the asset’s fair value is estimated and compared to its carrying value. An

impairment loss is recognized to the extent that the carrying amount exceeds the asset’s fair value. At the end of

2012, 2011 2010, we performed quantitative impairment tests of our trade name assets and no impairment was

recorded as a result.

Other Long-Lived Assets

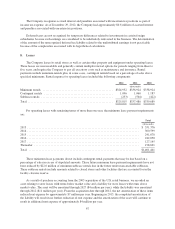

We are also required to test our long-lived assets for impairment whenever an indicator of potential

impairment exists. In 2012, 2011 and 2010, we noted the existence of indicators of potential impairment for the

assets of individual retail stores (“store assets” or “stores”), which consist primarily of leasehold improvements

and fixtures, and performed impairment testing for these assets. We performed the first step of impairment

testing for other long-lived assets on the store assets and determined that for some stores the estimated future

undiscounted cash flows derived from the assets was less than those assets’ carrying amounts and therefore

impairment existed for those store assets. We then performed the second step of impairment testing, which was

to calculate the amount of the impairment loss. The loss was measured as the excess of the carrying value over

the fair value of the assets, with the fair value determined based on estimated future discounted cash flows. As a

result of these tests, we impaired $11.4 million, $11.2 million and $11.0 million of store assets in 2012, 2011 and

2010, respectively.

62