OfficeMax 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Off-Balance-Sheet Activities and Guarantees

Note 15, “Commitments and Guarantees,” of the Notes to Consolidated Financial Statements in “Item 8.

Financial Statements and Supplementary Data” in this Form 10-K describes certain of our off-balance sheet

arrangements as well as the nature of our guarantees, including the approximate terms of the guarantees, how the

guarantees arose, the events or circumstances that would require us to perform under the guarantees and the

maximum potential undiscounted amounts of future payments we could be required to make.

Seasonal Influences

Our business is seasonal, with Retail showing a more pronounced seasonal trend than Contract. Sales in the

second quarter are historically the slowest of the year. Sales are stronger during the first, third and fourth quarters

which include the important new-year office supply restocking month of January, the back-to-school period and

the holiday selling season, respectively.

Disclosures of Financial Market Risks

Financial Instruments

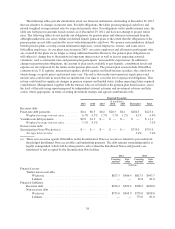

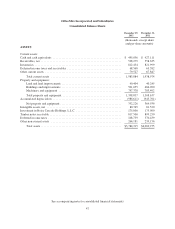

Our debt is predominantly fixed-rate. At December 29, 2012, the estimated current fair value of our debt,

based on quoted market prices when available or then-current interest rates for similar obligations with like

maturities, including the timber notes, was approximately $162 million more than the amount of debt reported in

the Consolidated Balance Sheets. As previously discussed, there is no recourse against OfficeMax on the

securitized timber notes payable as recourse is limited to proceeds from the applicable pledged Installment Notes

receivable and underlying guarantees. The debt and receivables related to the timber notes have fixed interest

rates and are reflected in the tables below, along with the carrying amounts and estimated fair values.

We were not a party to any material derivative financial instruments in 2012 or 2011.

37