OfficeMax 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

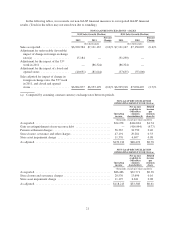

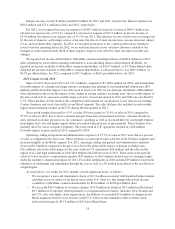

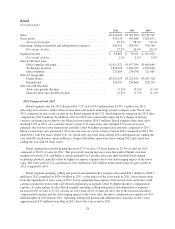

NON-GAAP RECONCILIATION

OPERATING RESULTS FOR 2010(a)

Operating

income

Net income

available to

OfficeMax

common

shareholders

Diluted

income

per

common

share

(thousands, except per-share amounts)

As reported ..................................................... $146,466 $68,628 $0.79

Store closure charges and severance adjustments ....................... 12,540 7,717 0.09

Store asset impairment charge ...................................... 10,979 6,708 0.08

Reserve adjustments related to legacy facility .......................... (9,463) (5,782) (0.07)

As adjusted ..................................................... $160,522 $77,271 $0.89

(a) Totals may not foot due to rounding.

(b) The conversion of preferred shares into common shares had a dilutive impact on earnings per share for 2012

due to the unusually large net income available to OfficeMax common shareholders, as a result of an agreement

that legally extinguished our non-recourse debt guaranteed by Lehman. Therefore, preferred dividends are

excluded from the income used to calculate diluted income per common share.

These items are described in more detail in this Management’s Discussion and Analysis.

At the end of the 2012 fiscal year, we had $495.1 million in cash and cash equivalents and $580.2 million in

available (unused) borrowing capacity under our revolving credit facility. At year-end, we had outstanding

recourse debt of $236.2 million (both current and long-term) and non-recourse obligations of $735.0 million

related to the timber securitization notes. There is no recourse against OfficeMax on the securitized timber notes

payable as recourse is limited to proceeds from the applicable pledged installment notes receivable and

underlying guarantees. The non-recourse debt declined significantly in 2012 due to an agreement that legally

extinguished our non-recourse debt guaranteed by Lehman. There were no borrowings on our credit agreements

in 2012.

The funded status of our pension plans improved in 2012. Our pension obligations exceeded the assets held

in trust to fund them by $301.4 million at year-end 2012, an improvement in funded status of $28.2 million,

compared to the $329.6 million underfunding that existed at year-end 2011. This improvement in funded status

was primarily due to higher than anticipated returns on investments and the impact of special-election lump sum

benefit payments, which were partially offset by an unfavorable change in the discount rate.

For full year 2012, operations provided $185.2 million of cash, while capital expenditures, net of proceeds

(including systems and infrastructure investments) and financing activities used $85.2 million and $34.8 million,

respectively.

Outlook

Based on the current environment and our 2012 trends, we expect that total sales for the full year of 2013

will be in line with 2012, including the favorable impact of foreign currency translation. Additionally, we expect

that the operating income margin rate for the full year of 2013 will be in line with the prior year adjusted rate,

despite the negative impact of increased rent expense resulting from the completed non-cash amortization of

liabilities related to the 2003 merger, as well of the discontinuation of dividend income due to the redemption of

our non-voting securities of Boise Cascade L.L.C.

We anticipate cash flow from operations in 2013 to be higher than capital expenditures, which we expect to

be approximately $100 million to $125 million, primarily related to investments in IT, ecommerce, infrastructure

and maintenance. We anticipate a net reduction in our retail square footage for the year, with five to ten store

closures and several new-format store openings in the U.S., and six expected store openings in Mexico.

22