OfficeMax 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

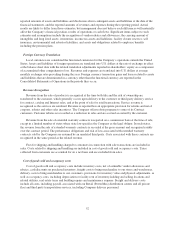

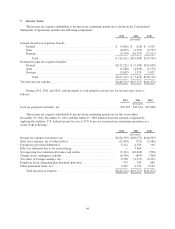

Facility closure reserve account activity during 2012, 2011 and 2010 was as follows:

Total

(thousands)

Balance at December 26, 2009 ......................................................... $ 61,572

Charges related to stores closed in 2010 ............................................. 13,069

Transfer of deferred rent balance ................................................... 5,985

Changes to estimated costs included in income ........................................ (1,358)

Cash payments ................................................................. (22,260)

Accretion ..................................................................... 4,665

Balance at December 25, 2010 ......................................................... $ 61,673

Charges related to stores closed in 2011 ............................................. 5,406

Transfer of deferred rent and other balances .......................................... 928

Changes to estimated costs included in income ........................................ 262

Cash payments ................................................................. (22,311)

Accretion ..................................................................... 3,117

Balance at December 31, 2011 ......................................................... $ 49,075

Charges related to stores closed in 2012 ............................................. 41,042

Transfer of deferred rent and other balances .......................................... 1,976

Cash payments ................................................................. (20,740)

Accretion ..................................................................... 3,290

Balance at December 29, 2012 ......................................................... $74,643

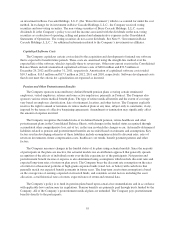

Reserve balances were classified in the Consolidated Balance Sheets as follows:

December 29,

2012

December 31,

2011

(thousands)

Accrued expenses and other current liabilities - Other ......................... $21,794 $10,635

Other long-term liabilities ............................................... 52,849 38,440

Total ................................................................ $74,643 $49,075

The facilities closure reserve consisted of the following:

December 29,

2012

(thousands)

Estimated future lease obligations .................................................... $126,842

Less: anticipated sublease income .................................................... (52,199)

Total ........................................................................... $ 74,643

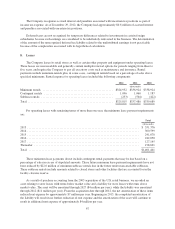

In addition, we were the lessee of a legacy building materials manufacturing facility near Elma, Washington

until the end of 2010. During 2006, we ceased operations at the facility, fully impaired the assets and recorded a

reserve for the related lease payments and other contract termination and closure costs. This reserve balance was

not included in the facilities closure reserve described above. During 2010, we sold the facility’s equipment and

terminated the lease and recorded income of approximately $9.4 million to adjust the associated reserve. This

income is reported in other operating expenses, net in our Consolidated Statements of Operations.

3. Severance and Other Charges

Over the past few years, we have incurred significant charges related to Company personnel restructuring

and reorganizations. These charges were included in other operating expenses, net in the Consolidated

Statements of Operations.

59