OfficeMax 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Selected Financial Data

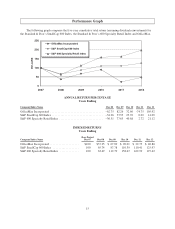

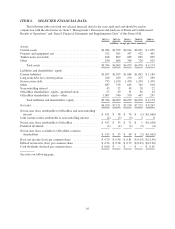

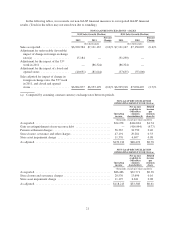

The company’s fiscal year-end is the last Saturday in December. For our U.S. businesses, there were 53

weeks in 2011 and 52 weeks for all other years presented.

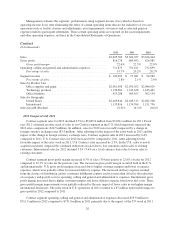

(a) 2012 included the following pre-tax items:

• $11.4 million charge for impairment of fixed assets associated with certain of our retail stores.

Our minority partner’s share of this charge of $0.4 million is included in joint venture results

attributable to noncontrolling interest.

• $56.4 million charge for accelerated pension expense related to participant settlements.

• $41.0 million charge for costs related to retail store closures in the U.S.

• $6.2 million charge for severance and other costs.

• $670.8 million gain related to an agreement that legally extinguished our non-recourse debt

guaranteed by Lehman Brothers Holdings, Inc. (“Lehman”).

(b) 2011 included the following pre-tax items:

• $14.9 million charge for severance and other costs.

• $11.2 million charge for impairment of fixed assets associated with certain of our retail stores in

the U.S.

• $5.6 million charge for costs related to retail store closures in the U.S.

(c) 2010 included the following pre-tax items:

• $11.0 million charge for impairment of fixed assets associated with certain of our retail stores in

the U.S.

• $13.1 million charge for costs related to retail store closures in the U.S., partially offset by a $0.6

million severance reserve adjustment.

• $9.4 million favorable adjustment of a reserve associated with our legacy building materials

manufacturing facility near Elma, Washington due to the sale of the facility’s equipment and the

termination of the lease.

(d) 2009 included the following items:

• $17.6 million pre-tax charge for impairment of fixed assets associated with certain of our retail

stores in the U.S. and Mexico. Our minority partner’s share of this charge of $1.2 million is

included in joint venture results attributable to noncontrolling interest.

• $31.2 million pre-tax charge for costs related to retail store closures in the U.S. and Mexico. Our

minority partner’s share of this charge of $0.5 million is included in joint venture results

attributable to noncontrolling interest.

• $18.1 million pre-tax charge for severance and other costs.

• $4.4 million pre-tax gain related to interest earned on a tax escrow balance established in a prior

period in connection with our legacy Voyageur Panel business.

• $2.6 million pre-tax gain related to the Company’s Boise Investment.

• $14.9 million of income tax benefit from the release of a tax uncertainty reserve upon resolution

of an issue under IRS appeal regarding the deductibility of interest on certain of our industrial

revenue bonds.

17