OfficeMax 2012 Annual Report Download - page 78

Download and view the complete annual report

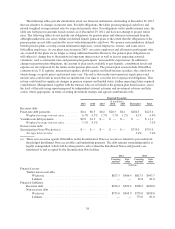

Please find page 78 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.due. These challenges may alter the timing or amount of taxable income or deductions, or the allocation of

income among tax jurisdictions. We recognize the benefits of tax positions that are more likely than not of being

sustained upon audit based on the technical merits of the tax position in the consolidated financial statements;

positions that do not meet this threshold are not recognized. For tax positions that are at least more likely than not

of being sustained upon audit, the largest amount of the benefit that is more likely than not of being sustained is

recognized in the consolidated financial statements. Years prior to 2006 are no longer subject to U.S. federal

income tax examination. During 2012, the Company effectively completed all audit work related to U.S. federal

income tax returns for the years 2006 through 2009 and expects final completion to occur in 2013. The Company

is no longer subject to state income tax examinations by tax authorities in its major state jurisdictions for years

before 2003, and the Company is no longer subject to income tax examinations prior to 2005 for its major foreign

jurisdictions.

In assessing the realizability of deferred tax assets, management considers whether it is more likely than not

that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax

assets is dependent upon the generation of future taxable income during the periods in which those temporary

differences become deductible. Management considers the scheduled reversal of deferred tax liabilities, projected

future taxable income, and tax planning strategies in making the assessment of whether it is more likely than not

that some portion or all of the deferred tax assets will not be realized.

Significant judgment is required in determining our uncertain tax positions. We have established accruals

for uncertain tax positions using management’s best judgment and adjust these liabilities as warranted by

changing facts and circumstances. A change in our uncertain tax positions, in any given period, could have a

significant impact on our results of operations and cash flows for that period.

The determination of the Company’s provision for income taxes requires significant judgment, the use of

estimates, and the interpretation and application of complex tax laws. Significant judgment is also required in

assessing the timing and amounts of deductible and taxable items.

Facility Closure Reserves

The Company conducts regular reviews of its real estate portfolio to identify underperforming facilities, and

closes those facilities that are no longer strategically or economically beneficial. A liability for the cost

associated with such a closure is recorded at its fair value in the period in which it is incurred, primarily the

location’s cease-use date. These costs are included in facility closure reserves and include provisions for the

present value of future lease obligations, less contractual or estimated sublease income. At December 29, 2012,

the vast majority of the reserve represents future lease obligations of $126.8 million, net of anticipated sublease

income of approximately $52.2 million. For each closed location, we estimate future sublease income based on

current real estate trends by market and location-specific factors, including the age and quality of the location, as

well as our historical experience with similar locations. If we had used different assumptions to estimate future

sublease income our reserves would be different and the difference could be material. In addition, if actual

sublease income is different than our estimates, adjustments to the recorded reserves may be required.

Environmental and Asbestos Reserves

Environmental and asbestos liabilities that relate to the operation of the paper and forest products businesses

and timberland assets prior to the sale of the paper, forest products and timberland assets continue to be liabilities

of OfficeMax. We are subject to a variety of environmental laws and regulations. We estimate our environmental

liabilities based on various assumptions and judgments, as we cannot predict with certainty the total response and

remedial costs, our share of total costs, the extent to which contributions will be available from other parties or

the amount of time necessary to complete any remediation. In making these judgments and assumptions, we

consider, among other things, the activity to date at particular sites, information obtained through consultation

with applicable regulatory authorities and third-party consultants and contractors and our historical experience at

42