OfficeMax 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

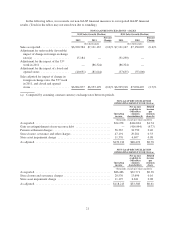

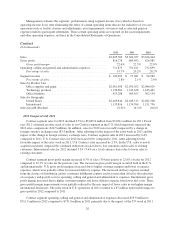

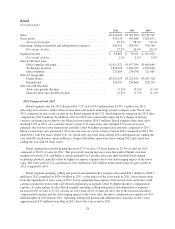

In the following tables, we reconcile our non-GAAP financial measures to our reported GAAP financial

results. (Totals in the tables may not sum down due to rounding.)

NON-GAAP RECONCILIATIONS – SALES

2012 Sales Growth (Decline) 2011 Sales Growth (Decline)

2012 2011

Percent

Change 2011 2010

Percent

Change

($ in thousands) ($ in thousands)

Sales as reported ................... $6,920,384 $7,121,167 (2.8)% $7,121,167 $7,150,007 (0.4)%

Adjustment for unfavorable (favorable)

impact of change in foreign exchange

rates(a) ........................ 15,184 — (91,290) —

Adjustment for the impact of the 53rd

week in 2011 ................... — (86,324) (86,324) —

Adjustment for the impact of closed and

opened stores ................... (40,691) (81,644) (37,635) (55,600)

Sales adjusted for impact of change in

foreign exchange rates, the 53rd week

in 2011, and closed and opened

stores .......................... $6,894,877 $6,953,199 (0.8)% $6,905,918 $7,094,407 (2.7)%

(a) Computed by assuming constant currency exchange rates between periods.

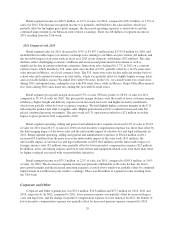

NON-GAAP RECONCILIATION

OPERATING RESULTS FOR 2012(a)

Operating

income

Net income

available to

OfficeMax

common

shareholders(b)

Diluted

income

per

common

share(b)

(thousands, except per-share amounts)

As reported ................................................... $24,278 $414,694 $4.74

Gain on extinguishment of non-recourse debt ........................ — (416,944) (4.77)

Pension settlement charges ....................................... 56,367 34,750 0.40

Store closure, severance and other charges ........................... 47,191 29,281 0.33

Store asset impairment charge .................................... 11,376 6,697 0.08

As adjusted ................................................... $139,212 $68,478 $0.78

NON-GAAP RECONCILIATION

OPERATING RESULTS FOR 2011(a)

Operating

income

Net income

available to

OfficeMax

common

shareholders

Diluted

income

per

common

share

(thousands, except per-share amounts)

As reported ................................................... $86,486 $32,771 $0.38

Store closure and severance charges ................................ 20,530 13,696 0.16

Store asset impairment charge .................................... 11,197 6,841 0.08

As adjusted ................................................... $118,213 $53,308 $0.61

21