OfficeMax 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

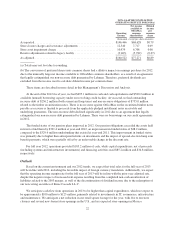

Two large transactions significantly affected the balance sheet during 2012. The first was our settlement

agreement that legally extinguished our non-recourse debt guaranteed by Lehman, which reduced non-recourse

debt and timber notes receivable, along with the use of available minimum tax credits and net operating losses to

offset the recognition of the related deferred tax gain, which reduced deferred taxes. The second was the non-

cash pension expense, which reduced accumulated other comprehensive loss and increased deferred tax assets.

We sponsor noncontributory defined benefit pension plans covering certain terminated employees, vested

employees, retirees, and some active employees, primarily in Contract. Pension expense was $3.3 million,

$10.9 million and $7.3 million for the years ended December 29, 2012, December 31, 2011 and December 25,

2010, respectively. In 2012, 2011 and 2010, we made cash contributions to our pension plans totaling

$21.1 million, $3.3 million and $3.4 million, respectively. The estimated minimum required funding contribution

in 2013 is $3.3 million and the expense is projected to be $2.7 million compared to expense of $3.3 million in

2012. In addition, we may elect to make additional voluntary contributions. See “Critical Accounting Estimates”

in this Management’s Discussion and Analysis of Financial Condition and Results of Operations for more

information.

During 2012, our pension plans were amended to provide a one-time special election period during which

certain former employees, alternate payees, and beneficiaries could elect to have their pension benefits under the

Plan paid as an immediate lump sum payment or an immediately commencing annuity. Approximately 9,800

participants were eligible to elect an immediate lump sum payment or annuity. Of those participants eligible,

approximately 300 elected an annuity while approximately 5,600 elected an immediate lump sum payment. The

associated distributions by the pension plans from plan funds were approximately $150 million, and resulted in a

non-cash pre-tax charge by the Company of $56 million to expense the accumulated loss relating to these

participants that otherwise would have been amortized over their life expectancies. This action reduced the

pension benefit obligation liability by approximately $190 million.

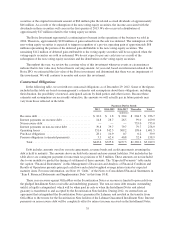

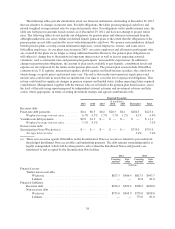

Investing Activities

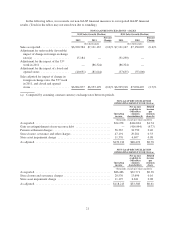

In 2012, capital spending of $87.2 million consisted of system improvements relating to our growth

initiatives, overall software enhancements and infrastructure improvements, as well as spending on new stores in

Mexico. In 2011, capital spending of $69.6 million consisted of system improvements, overall software

enhancements and infrastructure enhancements, as well as spending on new stores in Mexico. We also invested

in leasehold improvements. This spending was partially offset by proceeds from the sale of assets associated with

closed facilities. Details of the capital investment by segment are included in the following table:

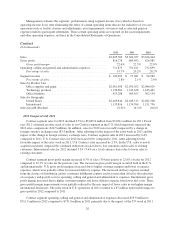

Capital Investment

2012 2011 2010

(millions)

Contract ................................................................ $39.3 $26.0 $61.2

Retail .................................................................. 47.3 35.8 32.3

Corporate and Other ....................................................... 0.6 7.8 —

Total ................................................................... $87.2 $69.6 $93.5

During 2012, we began considering potential options to sell our Croxley-branded wholesale, distribution

and manufacturing business in New Zealand (“Croxley”), a wholly-owned subsidiary included in our Contract

segment. We are in the process of assessing whether there is market or third-party interest that achieves our value

expectations. As such, management is not assured that a sale will occur within twelve months. Croxley’s net

book value was approximately $49 million at December 29, 2012.

31