OfficeMax 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

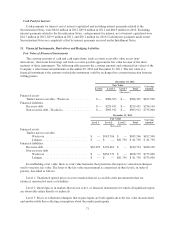

Common Stock

The Company is authorized to issue 200,000,000 shares of common stock, of which 86,883,521 shares were

issued and outstanding at December 29, 2012. Of the unissued shares, 9,352,668 shares were reserved for the

following purposes:

Conversion or redemption of Series D ESOP preferred stock ................................ 875,987

Issuance under 2003 OfficeMax Incentive and Performance Plan ............................. 8,410,834

Issuance under Director Stock Compensation Plan ........................................ 7,475

Issuance under 2001 Key Executive Deferred Compensation Plan ............................ 1,185

Issuance under 2003 Director Stock Compensation Plan .................................... 57,187

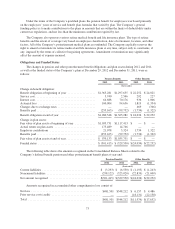

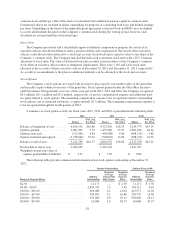

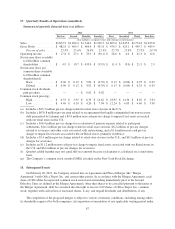

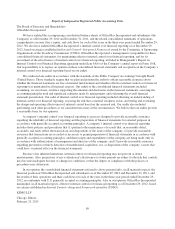

Accumulated Other Comprehensive Income (Loss)

Accumulated other comprehensive income (loss) includes the following:

Pension and

Postretirement

Liability

Adjustment

Foreign

Currency

Translation

Adjustment

Unrealized

Hedge Loss

Adjustment

Accumulated

Other

Comprehensive

Income (Loss)

(thousands)

Balance at December 25, 2010 ..................... $(236,823) $141,954 $ (884) $ (95,753)

Current-period changes, before taxes ................ (144,236) (6,195) 1,435 (148,996)

Income taxes ................................... 55,482 — (394) 55,088

Balance at December 31, 2011 ..................... $(325,577) $135,759 $ 157 $(189,661)

Current-period changes, before taxes ................ 60,732 15,170 (203) 75,699

Income taxes ................................... (23,605) — 46 (23,559)

Balance at December 29, 2012 ..................... $(288,450) $150,929 $ — $(137,521)

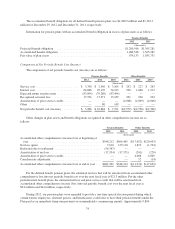

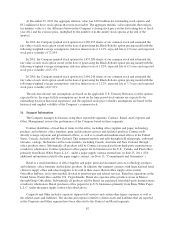

Share-Based Payments

The Company sponsors several share-based compensation plans, which are described below. The Company

recognizes compensation expense from all share-based payment transactions with employees in the consolidated

financial statements at fair value. Pre-tax compensation costs related to the Company’s share-based plans were

$10.3 million, $16.7 million and $13.2 million for 2012, 2011 and 2010, respectively. Compensation expense is

generally recognized on a straight-line basis over the vesting period of grants. The total income tax benefit

recognized in the Consolidated Statement of Operations for share-based compensation arrangements was

$4.0 million, $6.5 million and $5.1 million for 2012, 2011 and 2010, respectively.

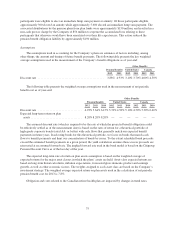

2003 Director Stock Compensation Plan and OfficeMax Incentive and Performance Plan

In February 2003, the Company’s Board of Directors adopted the 2003 Director Stock Compensation Plan

(the “2003 DSCP”) and the 2003 OfficeMax Incentive and Performance Plan (the “2003 Plan,” formerly named

the 2003 Boise Incentive and Performance Plan), which were approved by shareholders in April 2003. At

December 29, 2012, a total of 57,187 shares of common stock were reserved for issuance under the 2003 DSCP,

and a total of 8,410,834 shares of common stock were reserved for issuance under the 2003 Plan.

The 2003 Plan was effective January 1, 2003, and replaced the Key Executive Performance Plan for

Executive Officers, Key Executive Performance Plan for Key Executives/Key Managers, Key Executive Stock

Option Plan (“KESOP”), Key Executive Performance Unit Plan (“KEPUP”) and Director Stock Option Plan

(“DSOP”). No further grants or awards have been made under the Key Executive Performance Plans, KESOP,

KEPUP or DSOP since 2003.

79