OfficeMax 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Merchandise Inventories

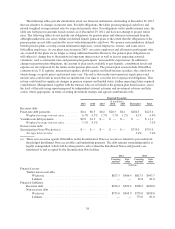

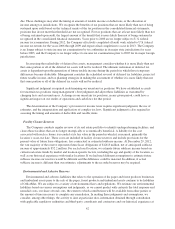

Inventories consist of office products merchandise and are stated at the lower of weighted average cost or

net realizable value. We estimate the realizable value of inventory using assumptions about future demand,

market conditions and product obsolescence. If the estimated realizable value is less than cost, the inventory

value is reduced to its estimated realizable value. If expectations regarding future demand and market conditions

are inaccurate or unexpected changes in technology or other factors affect demand, we could be exposed to

additional losses.

Throughout the year, we perform physical inventory counts at a significant number of our locations. For

periods subsequent to each location’s last physical inventory count, an allowance for estimated shrinkage is

provided based on historical shrinkage results and current business trends. If actual losses as a result of inventory

shrinkage are different than management’s estimates, adjustments to the allowance for inventory shrinkage may

be required.

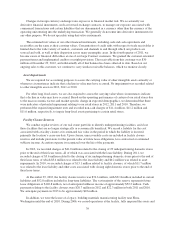

Pensions and Other Postretirement Benefits

The Company sponsors noncontributory defined benefit pension plans covering certain terminated

employees, vested employees, retirees, and some active employees, primarily in Contract. The Company also

sponsors various retiree medical benefit plans. At December 29, 2012, the funded status of our defined benefit

pension and other postretirement benefit plans was a liability of $325.4 million. Changes in assumptions related

to the measurement of funded status could have a material impact on the amount reported. We are required to

calculate our pension expense and liabilities using actuarial assumptions, including a discount rate assumption

and a long-term asset return assumption. We base our discount rate assumption on the rates of return for a

theoretical portfolio of high-grade corporate bonds (rated AA- or better) with cash flows that generally match our

expected benefit payments in future years. We base our long-term asset return assumption on the average rate of

earnings expected on invested funds. We believe that the accounting estimate related to pensions is a critical

accounting estimate because it is highly susceptible to change from period to period, based on the performance of

plan assets, actuarial valuations and changes in interest rates, and the effect on our financial position and results

of operations could be material.

For 2013, our discount rate assumption used in the measurement of our net periodic benefit cost is 3.88%,

and our expected return on plan assets is 7.80%. Using these assumptions, our 2013 pension expense will be

approximately $2.7 million. If we were to decrease our estimated discount rate assumption used in the

measurement of our net periodic benefit cost to 3.63% and our expected return on plan assets to 7.55%, our 2013

pension expense would be approximately $4.6 million. If we were to increase our discount rate assumption used

in the measurement of our net periodic benefit cost to 4.13% and our expected return on plan assets to 8.05%, our

2013 pension expense would be approximately $0.7 million.

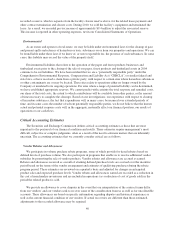

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to differences between the financial statement carrying

amounts of existing assets and liabilities and their respective tax basis and operating loss and tax credit

carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to

taxable income in the years in which those temporary differences are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that

includes the enactment date.

The Company is subject to tax audits in numerous jurisdictions in the U.S. and around the world. Tax audits

by their very nature are often complex and can require several years to complete. In the normal course of

business, the Company is subject to challenges from the IRS and other tax authorities regarding amounts of taxes

41