OfficeMax 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

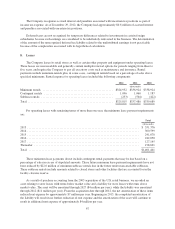

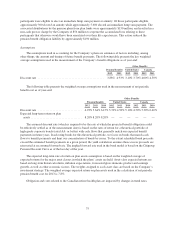

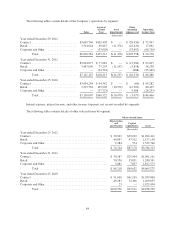

The following table presents the assumed healthcare cost trend rates used in measuring the Company’s

postretirement benefit obligations at December 29, 2012 and December 31, 2011:

2012 2011

Weighted average assumptions as of year-end:

Healthcare cost trend rate assumed for next year ........................................ 6.0% 6.5%

Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) ................ 5.0% 5.0%

Year that the rate reaches the ultimate trend rate ........................................ 2015 2015

A one-percentage-point change in the assumed healthcare cost trend rates would impact operating income

by approximately $1.5 million.

Plan Assets

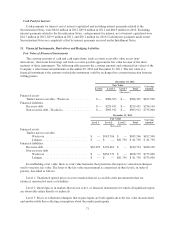

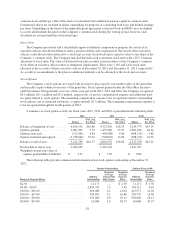

The allocation of pension plan assets by category at December 29, 2012 and December 31, 2011 is as

follows:

2012 2011

OfficeMax common stock ........................................................... 1.7% 1.2%

U.S. equity securities ............................................................... 31.0% 27.0%

International equity securities ........................................................ 15.3% 10.3%

Global equity securities ............................................................. 11.3% 15.8%

Fixed-income securities ............................................................ 40.7% 45.7%

100% 100%

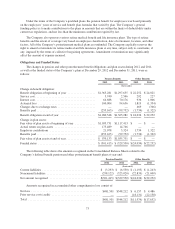

The Company’s Retirement Funds Investment Committee is responsible for establishing and overseeing the

implementation of the investment policy for the Company’s pension plans. The investment policy is structured to

optimize growth of the pension plan trust assets, while minimizing the risk of significant losses, in order to

enable the plans to satisfy their benefit payment obligations over time. Plan assets are invested primarily in

OfficeMax common stock, U.S. equities, global equities, international equities and fixed-income securities. The

Company uses benefit payments and Company contributions as its primary rebalancing mechanisms to maintain

the asset class exposures within the guideline ranges established under the investment policy.

The current asset allocation guidelines set forth an OfficeMax common stock range of 0% to 15%, a U.S.

equity range of 25% to 35%, an international equity range of 9% to 19%, a global equity range of 6% to 16% and

a fixed-income range of 38% to 48%. Asset-class positions within the ranges are continually evaluated and

adjusted based on expectations for future returns, the funded position of the plans and market risks. Occasionally,

the Company may utilize futures or other financial instruments to alter the pension trust’s exposure to various

asset classes in a lower-cost manner than trading securities in the underlying portfolios.

In 2009, we contributed 8.3 million shares of OfficeMax common stock to our qualified pension plans,

which are managed by an independent fiduciary. At the end of 2012, the plan held 1.7 million shares with a value

of $16.2 million.

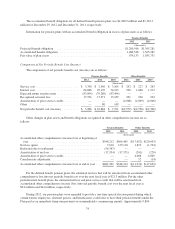

Generally, quoted market prices are used to value pension plan assets. Equities, some fixed-income

securities, publicly traded investment funds, and U.S. government obligations are valued by reference to

published market prices. Investments in certain restricted stocks are valued at the quoted market price of the

issuer’s unrestricted common stock less an appropriate discount. If a quoted market price for unrestricted

common stock of the issuer is not available, restricted common stocks are valued at a multiple of current earnings

less an appropriate discount. The multiple chosen is consistent with multiples of similar companies based on

current market prices.

76