OfficeMax 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

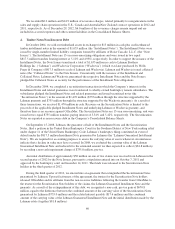

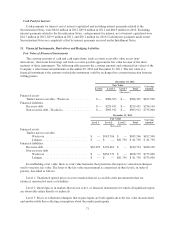

10. Debt

The Company’s debt, almost all of which is unsecured, consists of both recourse and non-recourse

obligations as follows at year-end:

2012 2011

(thousands)

Recourse debt:

7.35% debentures, due in 2016 ............................................. $ 17,967 $ 17,967

Medium-term notes, Series A, with interest rates averaging 7.9%, paid in 2012 ....... — 35,000

Revenue bonds, with interest rates averaging 6.4% , due in varying amounts

periodically through 2029 ............................................... 185,505 185,505

American & Foreign Power Company Inc. 5% debentures, due in 2030 ............. 18,526 18,526

Grupo OfficeMax installment loans, due in monthly installments through 2014 ....... 5,028 8,508

Other indebtedness, with interest rates averaging 6.6% and 6.8%, due in varying

amounts annually through 2019 ........................................... 9,644 3,188

$236,670 $ 268,694

Less unamortized discount ................................................. (476) (504)

Total recourse debt ................................................... $236,194 $ 268,190

Less current portion ...................................................... (10,232) (38,867)

Long-term debt, less current portion ................................. $225,962 $ 229,323

Non-recourse debt:

5.42% Securitization Notes, due in 2019 ...................................... $735,000 $ 735,000

5.54% Securitization Notes, due in 2019 ...................................... — 735,000

Total non-recourse debt ........................................... $735,000 $1,470,000

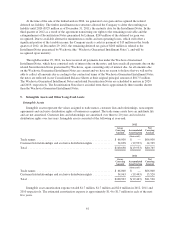

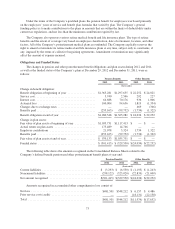

Scheduled Debt Maturities

The scheduled payments of recourse debt are as follows:

Total

(thousands)

2013 ............................................................................. $ 10,232

2014 ............................................................................. 1,574

2015 ............................................................................. 213

2016 ............................................................................. 20,264

2017 ............................................................................. 115

Thereafter ......................................................................... 204,272

Total ............................................................................. $236,670

Credit Agreements

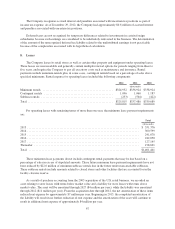

On October 7, 2011, the Company entered into a Second Amended and Restated Loan and Security

Agreement (the “Credit Agreement”) with a group of banks. The Credit Agreement amended both our then

existing credit agreement to which we were a party along with certain of our subsidiaries in the U.S. and our then

existing credit agreement to which our subsidiary in Canada was a party and consolidated them into a single

credit agreement. The Credit Agreement permits the Company to borrow up to a maximum of $650 million, of

which $50 million is allocated to the Company’s Canadian subsidiary and $600 million is allocated to the

Company and its other participating U.S. subsidiaries, in each case subject to a borrowing base calculation that

69