OfficeMax 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

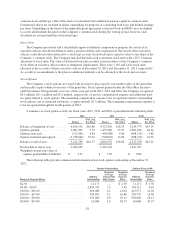

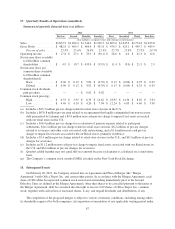

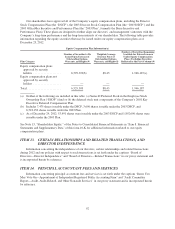

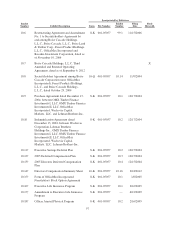

17. Quarterly Results of Operations (unaudited)

Summarized quarterly financial data is as follows:

2012 2011

First(a) Second Third(b) Fourth(c) First Second(d) Third Fourth(e)

($ in millions, except per-share and stock price information)

Sales .................. $1,872.9 $1,602.4 $1,744.6 $1,700.5 $1,863.0 $1,647.6 $1,774.8 $1,835.8

Gross Profit ............ $ 482.8 $ 409.5 $ 460.4 $ 431.8 $ 474.5 $ 425.1 $ 459.7 $ 449.9

Percent of sales ..... 25.8% 25.6% 26.4% 25.4% 25.5% 25.8% 25.9% 24.5%

Operating income ....... $ 17.8 $ 23.1 $ 33.5 $ (50.1) $ 28.6 $ 4.0 $ 41.3 $ 12.6

Net income (loss) available

to OfficeMax common

shareholders .......... $ 4.9 $ 10.7 $ 433.0 $ (33.9) $ 11.4 $ (3.0) $ 21.5 $ 2.9

Net income (loss) per

common share available

to OfficeMax common

shareholders(f)

Basic ............. $ 0.06 $ 0.12 $ 5.00 $ (0.39) $ 0.13 $ (0.04) $ 0.25 $ 0.03

Diluted ............ $ 0.06 $ 0.12 $ 4.92 $ (0.39) $ 0.13 $ (0.04) $ 0.25 $ 0.03

Common stock dividends

paid per share ......... — — $ 0.02 $ 0.02————

Common stock prices(g)

High .............. $ 6.33 $ 5.95 $ 8.33 $ 10.62 $ 18.95 $ 14.36 $ 8.82 $ 5.93

Low .............. $ 4.46 $ 4.10 $ 4.20 $ 7.04 $ 12.24 $ 6.05 $ 4.46 $ 3.90

(a) Includes a $25.3 million pre-tax charge related to retail store closures in the U.S.

(b) Includes a $670.8 million pre-tax gain related to an agreement that legally extinguished our non-recourse

debt guaranteed by Lehman and a $9.8 million non-cash pre-tax charge to impair fixed assets associated

with our retail stores in the U.S.

(c) Includes a $56.4 million pre-tax charge for acceleration of pension expense related to participant

settlements, $14.1 million pre-tax charge related to retail store closures, $6.2 million of pre-tax charges

related to severance and other costs associated with restructuring, and a $1.6 million non-cash pre-tax

charge to impair fixed assets associated with our Retail stores, primarily in Mexico.

(d) Includes a $5.6 million pre-tax charge related to retail store closures in the U.S., and $8.3 million of pre-tax

charges for severance.

(e) Includes an $11.2 million non-cash pre-tax charge to impair fixed assets associated with our Retail stores in

the U.S. and $6.6 million of pre-tax charges for severance.

(f) Quarters added together may not equal full year amount because each quarter is calculated on a stand-alone

basis.

(g) The Company’s common stock (symbol OMX) is traded on the New York Stock Exchange.

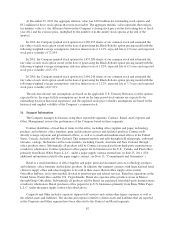

18. Subsequent Events

On February 20, 2013, the Company entered into an Agreement and Plan of Merger (the “Merger

Agreement”) with Office Depot, Inc. and certain other parties. In accordance with the Merger Agreement, each

share of OfficeMax Incorporated common stock issued and outstanding immediately prior to the Second

Effective Time (as defined in the Merger Agreement), other than shares to be cancelled pursuant to the terms of

the Merger Agreement, shall be converted into the right to receive 2.69 shares of Office Depot, Inc. common

stock, together with cash in lieu of fractional shares, if any, and unpaid dividends and distributions, if any.

The completion of the proposed merger is subject to various customary conditions, including among others

(i) shareholder approval by both companies, (ii) expiration or termination of any applicable waiting period under

87