OfficeMax 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

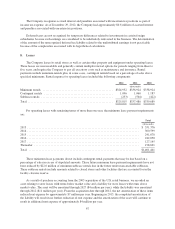

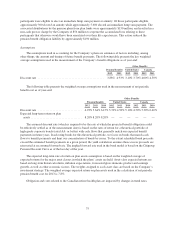

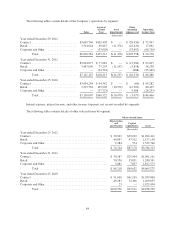

The following table presents the pension plan assets by level within the fair value hierarchy as of

December 29, 2012.

Level 1 Level 2 Level 3

(thousands)

Money market funds ................................................ $ — $ 26,244 $ —

Equity securities:

OfficeMax common stock ....................................... 16,232 — —

U.S. large-cap ................................................. 19,184 — —

U.S. small and mid-cap ......................................... 7,855 — —

International .................................................. 78,446 — —

Fixed-Income:

Corporate bonds ............................................... — 326,344 —

Government securities .......................................... — 13,378 —

Other fixed-income ............................................ — 29,286 —

Other:

Equity mutual funds ............................................ — 453,458 —

Group annuity contracts ......................................... — — 6,187

Other, including plan receivables and payables ....................... 2,519 — —

$124,236 $848,710 $6,187

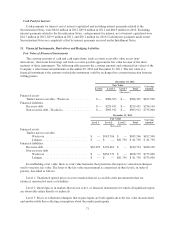

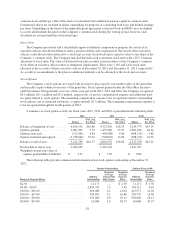

The following table presents the pension plan assets by level within the fair value hierarchy as of

December 31, 2011.

Level 1 Level 2 Level 3

(thousands)

Money market funds ................................................ $ — $ 19,280 $ —

Equity securities:

OfficeMax common stock ....................................... 12,585 — —

U.S. large-cap ................................................. 53,629 — —

U.S. small and mid-cap ......................................... 13,529 — —

International .................................................. 84,647 — —

Fixed-Income:

Corporate bonds ............................................... — 421,027 —

Government securities .......................................... — 7,785 —

Other fixed-income ............................................ — 24,907 —

Other:

Equity mutual funds ............................................ — 385,862 —

Group annuity contracts ......................................... — — 5,662

Other, including plan receivables and payables ....................... 5,665 1,153 —

$170,055 $860,014 $5,662

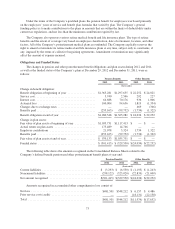

The following is a reconciliation of the change in fair value of the pension plan assets calculated based on

Level 3 inputs:

Total

(thousands)

Balance at December 31, 2011 ......................................................... $5,662

Benefit payments and administrative expenses ............................................ (9)

Invesment income and net appreciation in investments ...................................... 534

Balance at December 31, 2012 ......................................................... $6,187

77