OfficeMax 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

participants were eligible to elect an immediate lump sum payment or annuity. Of those participants eligible,

approximately 300 elected an annuity while approximately 5,600 elected an immediate lump sum payment. The

associated distributions by the pension plans from plan funds were approximately $150 million, and resulted in a

non-cash pre-tax charge by the Company of $56 million to expense the accumulated loss relating to these

participants that otherwise would have been amortized over their life expectancies. This action reduced the

pension benefit obligation liability by approximately $190 million.

Assumptions

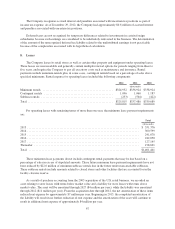

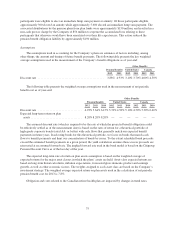

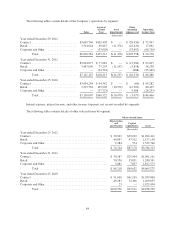

The assumptions used in accounting for the Company’s plans are estimates of factors including, among

other things, the amount and timing of future benefit payments. The following table presents the key weighted

average assumptions used in the measurement of the Company’s benefit obligations as of year-end:

Other Benefits

Pension Benefits United States Canada

2012 2011 2012 2011 2012 2011

Discount rate ............................................. 3.88% 4.93% 3.10% 3.70% 4.00% 4.50%

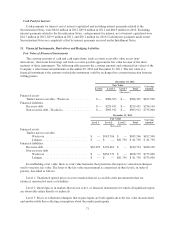

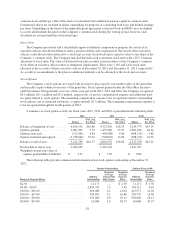

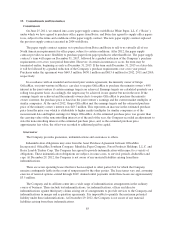

The following table presents the weighted average assumptions used in the measurement of net periodic

benefit cost as of year-end:

Other Benefits

Pension Benefits United States Canada

2012 2011 2010 2012 2011 2010 2012 2011 2010

Discount rate .............................. 4.93% 5.64% 6.15% 3.70% 4.50% 5.10% 4.50% 5.30% 6.40%

Expected long-term return on plan

assets ................................... 8.20% 8.20% 8.20% ——————

The assumed discount rate (which is required to be the rate at which the projected benefit obligation could

be effectively settled as of the measurement date) is based on the rates of return for a theoretical portfolio of

high-grade corporate bonds (rated AA- or better) with cash flows that generally match our expected benefit

payments in future years. In selecting bonds for this theoretical portfolio, we focus on bonds that match cash

flows to benefit payments and limit our concentration of bonds by issuer. To the extent scheduled bond proceeds

exceed the estimated benefit payments in a given period, the yield calculation assumes those excess proceeds are

reinvested at an assumed forward rate. The implied forward rate used in the bond model is based on the Citigroup

Pension Discount Curve as of the last day of the year.

The expected long-term rate of return on plan assets assumption is based on the weighted average of

expected returns for the major asset classes in which the plans’ assets are held. Asset-class expected returns are

based on long-term historical returns, inflation expectations, forecasted gross domestic product and earnings

growth, as well as other economic factors. The weights assigned to each asset class are based on the Company’s

investment strategy. The weighted average expected return on plan assets used in the calculation of net periodic

pension benefit cost for 2013 is 7.8%.

Obligation and costs related to the Canadian retiree health plan are impacted by changes in trend rates.

75