OfficeMax 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.instrument is designated as a fair value hedge, changes in the fair value of the instrument are reported in current

earnings and offset the change in fair value of the hedged assets, liabilities or firm commitments. The Company

has no material outstanding derivative instruments at December 29, 2012 and did not have any material hedge

transactions in 2012, 2011 or 2010.

Recently Issued or Newly Adopted Accounting Standards

In July 2012, the FASB issued guidance that permits an entity to make a qualitative assessment to determine

whether it is more likely than not that an indefinite-lived intangible asset, other than goodwill, is impaired. If,

after making the qualitative assessment, an entity determines it is not more likely than not that the fair value of an

indefinite-lived intangible asset is less than its carrying amount, then performing a quantitative impairment test is

unnecessary. This guidance, which was adopted for the third quarter of 2012, did not have any impact on the

Company’s results of operations, financial position, or cash flows.

In February 2013, the FASB issued guidance which expands disclosure requirements for other

comprehensive income. The guidance requires the reporting of the effect of the reclassification of items out of

accumulated other comprehensive income (AOCI) on each affected net income line item. The guidance is

effective for interim and annual periods beginning on or after December 15, 2012 and is to be applied

prospectively. The adoption of this guidance affects the presentation of certain elements of the Company’s

financial statements, but these changes in presentation will not have a material impact on our financial

statements.

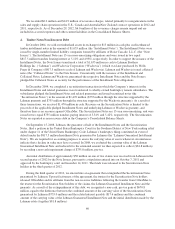

2. Facility Closure Reserves

We conduct regular reviews of our real estate portfolio to identify underperforming facilities, and close

those facilities that are no longer strategically or economically beneficial. We record a liability for the cost

associated with a facility closure at its estimated fair value in the period in which the liability is incurred,

primarily the location’s cease-use date. Upon closure, unrecoverable costs are included in facility closure

reserves and include provisions for the present value of future lease obligations, less contractual or estimated

sublease income. These facility closure charges are included in other operating expenses, net in the Consolidated

Statements of Operations. Accretion expense is recognized over the life of the required payments and is included

in operating, selling, and general and administrative expenses in the Consolidated Statements of Operations.

During 2012, we recorded facility closure charges of $41.0 million in our Retail segment related to closing

29 underperforming domestic stores prior to the end of their lease terms, all of which was related to the lease

liability.

During 2011, we recorded facility closure charges of $5.6 million in our Retail segment related to closing

six underperforming domestic stores prior to the end of their lease terms, of which $5.4 million was related to the

lease liability and $0.2 million was related to asset impairments. During 2010, we recorded facility closure

charges of $13.1 million in our Retail segment, of which $11.7 million was related to the lease liability and other

costs associated with closing eight domestic stores prior to the end of their lease terms, and $1.4 million was

related to other items.

58