OfficeMax 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

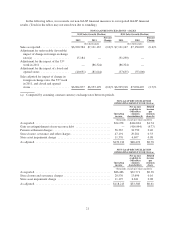

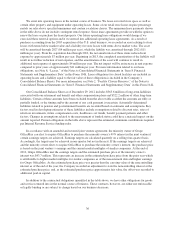

Management evaluates the segments’ performances using segment income (loss) which is based on

operating income (loss) after eliminating the effect of certain operating items that are not indicative of our core

operations such as facility closures and adjustments, asset impairments, severances and accelerated pension

expense related to participant settlements. These certain operating items are reported on the asset impairments

and other operating expenses, net lines in the Consolidated Statements of Operations.

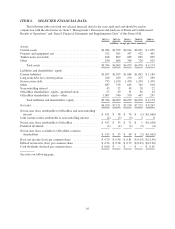

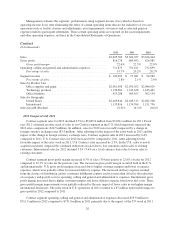

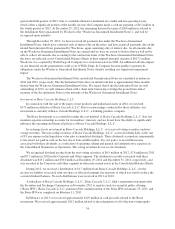

Contract

($ in thousands)

2012 2011 2010

Sales ..................................................... $3,605,760 $3,624,077 $3,634,244

Gross profit ................................................ 814,278 809,492 826,981

Gross profit margin ...................................... 22.6% 22.3% 22.8%

Operating, selling and general and administrative expenses .......... 711,875 731,811 732,699

Percentage of sales ...................................... 19.7% 20.2% 20.2%

Segment income ............................................ $ 102,403 $ 77,681 $ 94,282

Percentage of sales ...................................... 2.8% 2.1% 2.6%

Sales by Product Line

Office supplies and paper ................................. $2,061,908 $2,076,052 $2,086,629

Technology products ..................................... 1,130,564 1,142,168 1,185,461

Office furniture ......................................... 413,288 405,857 362,154

Sales by Geography

United States ........................................... $2,469,944 $2,449,313 $2,482,508

International ........................................... 1,135,816 1,174,764 1,151,736

Sales Growth (Decline) ....................................... (0.5)% (0.3)% (0.6)%

2012 Compared with 2011

Contract segment sales for 2012 declined 0.5% to $3,605.8 million from $3,624.1 million for 2011. Fiscal

year 2011 contained an extra week of sales in our Contract segment in the U.S. which negatively impacted the

2012 sales comparisons ($34.5 million). In addition, sales for 2012 were favorably impacted by a change in

foreign currency exchange rates ($3.4 million). After adjusting for the impact of the extra week in 2011 and the

impact of the change in foreign currency exchange rates, Contract segment sales in 2012 increased by 0.4%

compared to 2011. U.S. Contract sales for 2012 increased 0.8% compared to 2011. After adjusting for the

favorable impact of the extra week in 2011, U.S. Contract sales increased by 2.3%. In the U.S., sales to newly

acquired customers outpaced the combined reductions in sales due to lost customers and in sales to existing

customers. International sales for 2012 declined 3.3% (3.6% on a local currency basis) due to lower sales to

existing customers.

Contract segment gross profit margin increased 0.3% of sales (30 basis points) to 22.6% of sales for 2012

compared to 22.3% of sales for the previous year. The increase in gross profit margin occurred both in the U.S.

and internationally. U.S. gross profit margins increased due to higher customer margins and lower occupancy

expenses, which were partially offset by increased delivery expense. The increased delivery expense resulted

from the closure of distribution centers (customer fulfillment centers) and was more than offset by the reduction

of occupancy and payroll costs in operating, selling and general and administrative expenses. International gross

profit margin increased due to higher customer margins and lower delivery expense from lower fuel costs. These

gross profit margin improvements were partially reduced by the mix impact of lower sales in our higher-margin

international businesses. The extra week in U.S. operations in 2011 resulted in a $7 million unfavorable impact to

gross profit in 2012 compared to 2011.

Contract segment operating, selling and general and administrative expenses decreased $19.9 million to

$711.9 million in 2012 compared to $731.8 million in 2011 primarily due to the impact of the 53rd week in 2011

26