OfficeMax 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our international operations expose us to the unique risks inherent in foreign operations. Our foreign

operations encounter risks similar to those faced by our U.S. operations, as well as risks inherent in foreign

operations, such as local customs and regulatory constraints, foreign trade policies, competitive conditions,

foreign currency fluctuations and unstable political and economic conditions.

We may be unable to attract and retain qualified associates. We attempt to attract and retain an appropriate

level of personnel in both field operations and corporate functions. We face many external risks and internal

factors in meeting our labor needs, including competition for qualified personnel, prevailing wage rates, as well

as rising employee benefit costs, including insurance costs and compensation programs. Failure to attract and

retain sufficient qualified personnel could interfere with our ability to implement our strategies and adequately

provide services to customers.

We are more leveraged than some of our competitors, which could adversely affect our business plans. A

relatively greater portion of our cash flow is used to service financial obligations including leases and to satisfy

Pension Plans funding obligations (discussed previously). This reduces the funds we have available for working

capital, capital expenditures, acquisitions, new stores, store remodels and other purposes. Similarly, our relatively

greater leverage increases our vulnerability to, and limits our flexibility in planning for, adverse economic and

industry conditions and creates other competitive disadvantages compared with other companies with relatively

less leverage.

Compromises of our information security affecting customer or associate data may adversely affect our

business. Through our sales and marketing activities, we collect and store certain personal information that our

customers provide to purchase products or services, enroll in promotional programs, register on our website, or

otherwise communicate and interact with us. We also gather and retain information about our associates in the

normal course of business. We may share information about such persons with vendors that assist with certain

aspects of our business. Despite instituted safeguards for the protection of such information, we cannot be certain

that all of our systems are entirely free from vulnerability to attack. Computer hackers may attempt to penetrate

our networks or our vendors’ network security and, if successful, misappropriate confidential customer or

business information. In addition, a Company employee, contractor or other third party with whom we do

business may attempt to circumvent our security measures in order to obtain such information or inadvertently

cause a breach involving such information. Loss of customer or business information could disrupt our

operations and expose us to claims from customers, financial institutions, payment card associations and other

persons, which could have a material adverse effect on our business, financial condition and results of operations.

We cannot ensure systems and technology will be fully integrated or updated. We cannot ensure our

systems and technology will be successfully updated. We have plans to continue to update the financial reporting

platform as well as other technology and systems. We will be implementing ongoing upgrades over the next

several years which is a complicated and difficult endeavor. Failure to successfully complete these upgrades

could have an adverse impact on our business and results of operations. Over the last several years, we have

partially integrated the systems of our Contract and Retail businesses. If we do not ultimately fully integrate our

systems, it may constrain our ability to provide the level of service our customers demand which could thereby

cause us to operate inefficiently. In addition, if we are unable to continually add software and hardware,

effectively manage and upgrade our systems and network infrastructure and develop disaster recovery plans, our

business could be disrupted, thus subjecting us to liability and potentially harming our reputation. Any disruption

to the Internet or our technology infrastructure, including a disruption affecting our Web sites and information

systems, may cause a decline in our customer satisfaction, jeopardize accurate financial reporting, impact our

sales volumes or result in increased costs.

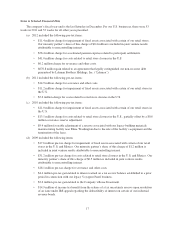

We retained responsibility for certain liabilities of the sold paper, forest products and timberland

businesses. In connection with the Sale, we agreed to assume responsibility for certain liabilities of the

businesses we sold. These obligations include liabilities related to environmental, health and safety, tax, litigation

and employee benefit matters. Some of these retained liabilities could turn out to be significant, which could

7