OfficeMax 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

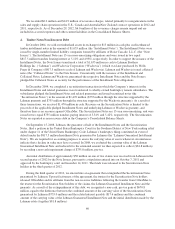

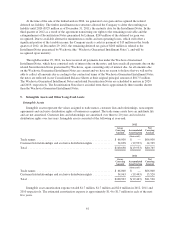

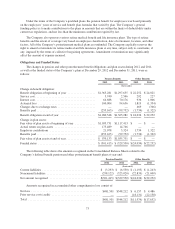

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

deferred tax liabilities at year-end are presented in the following table:

2012 2011

(thousands)

Impairment of note receivable .............................................. $ — $278,269

Minimum tax and other credits carryover ..................................... 121,434 228,224

Net operating loss carryovers ............................................... 31,798 151,787

Deferred gain on Boise Investment .......................................... 68,936 68,936

Compensation obligations ................................................. 177,784 172,403

Operating reserves and accrued expenses ..................................... 50,239 55,679

Investments and deferred charges ........................................... 5,901 3,441

Property and equipment ................................................... — 1,558

Allowances for receivables ................................................. 12,358 12,306

Inventory ............................................................... 6,258 4,216

Tax goodwill ............................................................ 1,319 2,907

Other .................................................................. — 6,891

Total deferred tax assets ................................................... $476,027 $ 986,617

Valuation allowance on NOLs and credits ..................................... $ (30,665) $ (25,543)

Total deferred tax assets after valuation allowance .............................. $445,362 $ 961,074

Timberland installment gain related to Wachovia Guaranteed Installment Note ....... $(260,040) $(260,040)

Timberland installment gain related to Lehman Guaranteed Installment Note ......... — (269,284)

Property and equipment ................................................... (3,290) —

Undistributed earnings .................................................... (6,238) (5,823)

Other .................................................................. (3,157) —

Total deferred tax liabilities ................................................ $(272,725) $(535,147)

Total net deferred tax assets ................................................ $172,637 $ 425,927

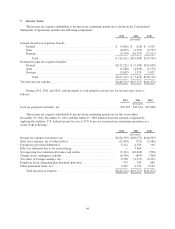

Deferred tax assets and liabilities are reported in our Consolidated Balance Sheets as follows:

2012 2011

(thousands)

Current deferred income tax assets ............................................ $ 63,878 $ 55,488

Long-term deferred income tax assets ......................................... 108,759 370,439

Total net deferred tax assets ............................................. $172,637 $425,927

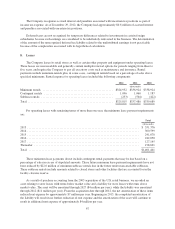

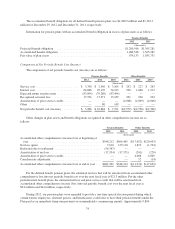

In assessing the value of deferred tax assets, management considers whether it is more likely than not that

some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is

dependent upon the generation of future taxable income during the periods in which those temporary differences

become deductible. Management considers the scheduled reversal of deferred tax liabilities, projected future

taxable income, and tax planning strategies in making the assessment of whether it is more likely than not that

some portion or all of the deferred tax assets will not be realized. Management believes it is more likely than not

that the Company will realize the benefits of these deductible differences, except for certain state net operating

losses and other credit carryforwards as noted below. The amount of the deferred tax assets considered realizable,

however, could be reduced if estimates of future taxable income during the carryforward period are reduced.

During 2011, the Company restructured its domestic entities to better support operations resulting in a reduction

in the tax rate related to certain deferred items which was offset by the impairment of state net operating losses.

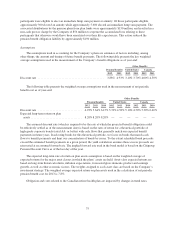

The Company has a deferred tax asset related to alternative minimum tax credit carryforwards of

approximately $100 million, which are available to reduce future regular federal income taxes, if any, over an

65