OfficeMax 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

securities at the original investment amount of $66 million plus the related accrued dividends of approximately

$46 million. As a result of the redemption of the non-voting equity securities, the income associated with the

dividends on those securities will cease in the first quarter of 2013. We also received a distribution of

approximately $17 million related to the voting equity securities.

The Boise Investment represented a continuing involvement in the operations of the business we sold in

2004. Therefore, approximately $180 million of gain realized from the sale was deferred. The redemption of the

non-voting equity securities is expected to trigger recognition of a pre-tax operating gain of approximately $68

million representing the portion of the deferred gain attributable to the non-voting equity securities. The

remaining $112 million of deferred gain attributable to the voting equity securities will be recognized when the

voting-equity securities are sold or redeemed. We do not expect to pay any cash taxes as a result of the

redemption of the non-voting equity securities and the distribution on the voting equity securities.

Throughout the year, we review the carrying value of this investment whenever events or circumstances

indicate that its fair value may be less than its carrying amount. At year-end, based on information related to the

Boise IPO, we estimated the fair value of the Boise investment, and determined that there was no impairment of

this investment. We will continue to monitor and assess this investment.

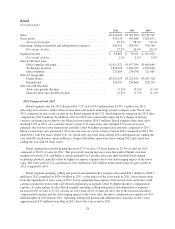

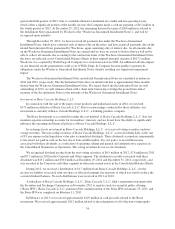

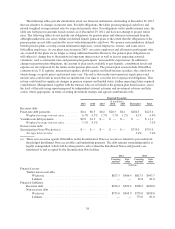

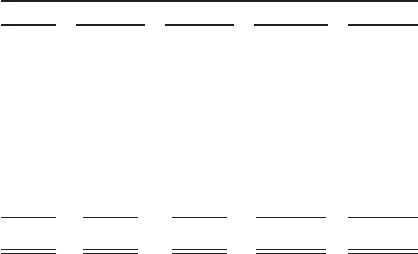

Contractual Obligations

In the following table, we set forth our contractual obligations as of December 29, 2012. Some of the figures

included in this table are based on management’s estimates and assumptions about these obligations, including

their duration, the possibility of renewal, anticipated actions by third parties and other factors. Because these

estimates and assumptions are necessarily subjective, the amounts we will actually pay in future periods may

vary from those reflected in the table.

Payments Due by Period

2013 2014-2015 2016-2017 Thereafter Total

(millions)

Recourse debt .................................... $ 10.2 $ 1.8 $ 20.4 $ 204.3 $ 236.7

Interest payments on recourse debt ................... 14.8 28.7 26.5 99.0 169.0

Non-recourse debt ................................ — — — 735.0 735.0

Interest payments on non-recourse debt ............... 39.8 79.7 79.7 79.7 278.9

Operating leases .................................. 351.4 542.3 309.2 198.6 1,401.5

Purchase obligations .............................. 28.1 10.9 0.7 0.2 39.9

Pension obligations (estimated payments) .............. 3.3 62.4 40.8 52.4 158.9

Total ....................................... $447.6 $725.8 $477.3 $1,369.2 $3,019.9

Debt includes amounts owed on our note agreements, revenue bonds and credit agreements assuming the

debt is held to maturity. The amounts above include both current and non-current liabilities. Not included in the

table above are contingent payments for uncertain tax positions of $6.3 million. These amounts are not included

due to our inability to predict the timing of settlement of these amounts. The “Expected Payments” table under

the caption “Financial Instruments” in this Management’s Discussion and Analysis of Financial Condition and

Results of Operations presents principal cash flows and related weighted average interest rates by expected

maturity dates. For more information, see Note 10, “Debt,” of the Notes to Consolidated Financial Statements in

“Item 8. Financial Statements and Supplementary Data” in this form 10-K.

There is no recourse against OfficeMax on the Securitization Notes as recourse is limited to proceeds from

the pledged Installment Notes receivable and underlying guaranty. The non-recourse debt remains outstanding

until it is legally extinguished, which will be when paid in cash or when the Installment Notes and related

guaranty is transferred to and accepted by the Securitization Note holders. During 2012, we entered into an

agreement that extinguished the Securitization Notes guaranteed by Lehman, and resulted in the transfer from

OfficeMax to the trustee for the Securitization Note holders of the Lehman Guaranteed Installment Note. Interest

payments on non-recourse debt will be completely offset by interest income received on the Installment Notes.

35