OfficeMax 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

indefinite period. The Company also has deferred tax assets related to various state net operating losses of

approximately $15.0 million, net of the valuation allowance, that expire between 2013 and 2029.

The Company has established a valuation allowance related to net operating loss carryforwards and other

credit carryforwards in jurisdictions where the Company has substantially reduced operations because

management believes it is more likely than not that these items will expire before the Company is able to realize

their benefits. The valuation allowance was $30.7 million and $25.5 million at December 29, 2012 and

December 31, 2011, respectively. In 2012, the Company increased the valuation allowances relating to its

available foreign tax credits. The valuation allowance is reviewed and adjusted based on management’s

assessments of realizable deferred tax assets.

As discussed in Note 4, “Timber Notes/Non-Recourse Debt,” at the time of the sale of the timberlands in

2004, we generated a tax gain and recognized the related deferred tax liability. The timber installment notes

structure allowed the Company to defer the resulting tax liability until 2020, the maturity date for the Installment

Notes. In 2011, a legal entity restructuring reduced the liability for the installment gain by $14 million to $529

million. The recognition of the tax gain related to the Securitization Notes guaranteed by Lehman ($269 million)

was triggered in full by the agreement entered into in the third quarter of 2012 and was recognized. The

recognized gain amount was predominately offset by alternative minimum tax credits and net operating losses,

and the Company made a cash tax payment of $15 million for the remainder. At December 29, 2012, the

remaining tax liability of $260 million is related to the Wachovia Guaranteed Installment Notes and will be

recognized when the Wachovia Guaranteed Installment Notes are paid.

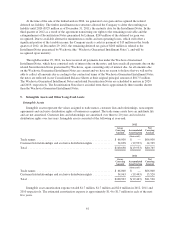

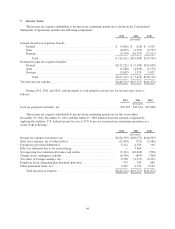

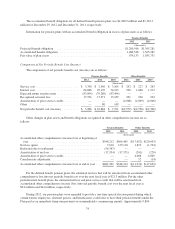

Pre-tax income related to continuing operations from domestic and foreign sources is as follows:

2012 2011 2010

(thousands)

Domestic ........................................................ $607,487 $21,202 $ 53,444

Foreign ......................................................... 62,053 36,435 62,292

Total ........................................................... $669,540 $57,637 $115,736

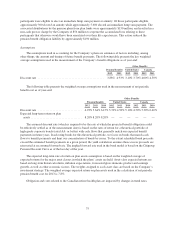

As of December 29, 2012, the Company had $6.3 million of total unrecognized tax benefits, $6.2 million of

which would affect the Company’s effective tax rate if recognized. During 2012, the reserve was reduced for tax

positions related to positions that the Company had effectively settled with the IRS. Any future adjustments

would result from the effective settlement of tax positions with various tax authorities. The Company does not

anticipate any tax settlements to occur within the next twelve months. The reconciliation of the beginning and

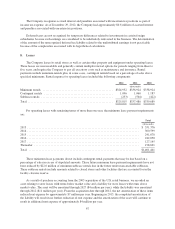

ending unrecognized tax benefits is as follows:

2012 2011 2010

(thousands)

Unrecognized gross tax benefits balance at beginning of year ................ $21,172 $20,863 $ 8,247

Increase related to prior year tax positions ............................... 2,178 570 12,983

Decrease related to prior year tax positions .............................. (12,232) — —

Settlements ....................................................... (4,781) (261) (367)

Unrecognized tax benefits balance at end of year ......................... $ 6,337 $21,172 $20,863

The Company or its subsidiaries file income tax returns in the U.S. federal jurisdiction, and multiple state

and foreign jurisdictions. Years prior to 2006 are no longer subject to U.S. federal income tax examination.

During 2012, the Company effectively completed all audit work related to U.S. federal income tax returns for the

years 2006 through 2009 and expects final completion to occur in 2013. The Company is no longer subject to

state income tax examinations by tax authorities in its major state jurisdictions for years before 2003, and the

Company is no longer subject to income tax examinations prior to 2005 for its major foreign jurisdictions.

66