OfficeMax 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

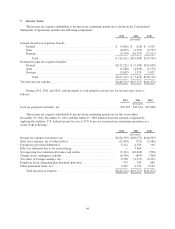

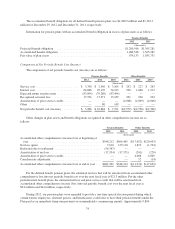

The Company recognizes accrued interest and penalties associated with uncertain tax positions as part of

income tax expense. As of December 29, 2012, the Company had approximately $0.6 million of accrued interest

and penalties associated with uncertain tax positions.

Deferred taxes are not recognized for temporary differences related to investments in certain foreign

subsidiaries because such earnings are considered to be indefinitely reinvested in the business. The determination

of the amount of the unrecognized deferred tax liability related to the undistributed earnings is not practicable

because of the complexities associated with its hypothetical calculation.

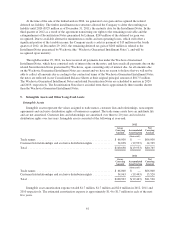

8. Leases

The Company leases its retail stores as well as certain other property and equipment under operating leases.

These leases are noncancelable and generally contain multiple renewal options for periods ranging from three to

five years, and require the Company to pay all executory costs such as maintenance and insurance. Rental

payments include minimum rentals plus, in some cases, contingent rentals based on a percentage of sales above

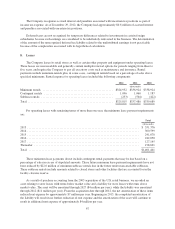

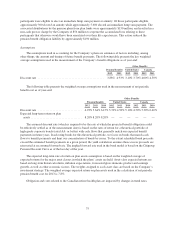

specified minimums. Rental expense for operating leases included the following components:

2012 2011 2010

(thousands)

Minimum rentals ................................................ $324,952 $336,924 $338,924

Contingent rentals ............................................... 1,096 1,060 1,187

Sublease rentals ................................................. (233) (504) (422)

Total .......................................................... $325,815 $337,480 $339,689

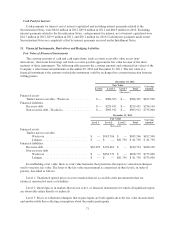

For operating leases with remaining terms of more than one year, the minimum lease payment requirements

are:

Total

(thousands)

2013 ............................................................................ $ 351,376

2014 ............................................................................ 300,599

2015 ............................................................................ 241,670

2016 ............................................................................ 182,050

2017 ............................................................................ 127,165

Thereafter ....................................................................... 198,601

Total ........................................................................... $1,401,461

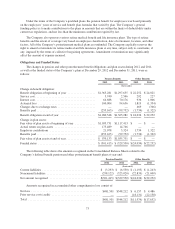

These minimum lease payments do not include contingent rental payments that may be due based on a

percentage of sales in excess of stipulated amounts. These future minimum lease payment requirements have not

been reduced by $22.6 million of minimum sublease rentals due in the future under noncancelable subleases.

These sublease rentals include amounts related to closed stores and other facilities that are accounted for in the

facility closures reserve.

As a result of purchase accounting from the 2003 acquisition of the U.S. retail business, we recorded an

asset relating to store leases with terms below market value and a liability for store leases with terms above

market value. The asset will be amortized through 2027 ($4 million per year), while the liability was amortized

through 2012 ($11 million per year). From the acquisition date through 2012, the net amortization of these items

reduced rent expense by approximately $7 million per year. Beginning in 2013, the completed amortization of

the liability will result in no further reduction of rent expense and the amortization of the asset will continue to

result in additional rent expense of approximately $4 million per year.

67