OfficeMax 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

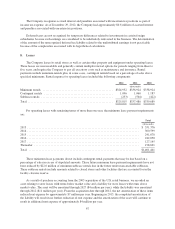

Under the terms of the Company’s qualified plans, the pension benefit for employees was based primarily

on the employees’ years of service and benefit plan formulas that varied by plan. The Company’s general

funding policy is to make contributions to the plans in amounts that are within the limits of deductibility under

current tax regulations, and not less than the minimum contribution required by law.

The Company also sponsors various retiree medical benefit and life insurance plans. The type of retiree

benefits and the extent of coverage vary based on employee classification, date of retirement, location, and other

factors. All of the Company’s postretirement medical plans are unfunded. The Company explicitly reserves the

right to amend or terminate its retiree medical and life insurance plans at any time, subject only to constraints, if

any, imposed by the terms of collective bargaining agreements. Amendment or termination may significantly

affect the amount of expense incurred.

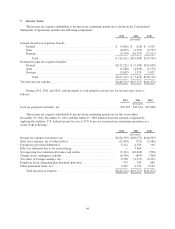

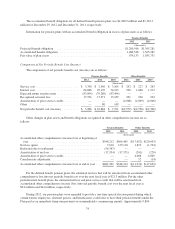

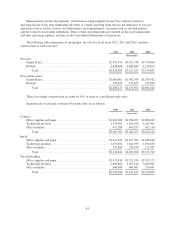

Obligations and Funded Status

The changes in pension and other postretirement benefit obligations and plan assets during 2012 and 2011,

as well as the funded status of the Company’s plans at December 29, 2012 and December 31, 2011, were as

follows:

Pension Benefits Other Benefits

2012 2011 2012 2011

(thousands)

Change in benefit obligation:

Benefit obligation at beginning of year ................... $1,365,281 $1,297,655 $ 22,252 $ 24,021

Service cost ......................................... 3,740 2,546 292 227

Interest cost ......................................... 64,688 70,176 936 1,006

Actuarial loss ....................................... 100,004 94,656 1,819 (1,334)

Changes due to exchange rates .......................... — — 469 (346)

Benefits paid ........................................ (253,165) (99,752) (1,734) (1,322)

Benefit obligation at end of year ........................ $1,280,548 $1,365,281 $ 24,034 $ 22,252

Change in plan assets:

Fair value of plan assets at beginning of year .............. $1,035,731 $1,117,413 $ — $ —

Actual return on plan assets ............................ 175,489 14,746 — —

Employer contributions ............................... 21,078 3,324 1,734 1,322

Benefits paid ........................................ (253,165) (99,752) (1,734) (1,322)

Fair value of plan assets at end of year .................... $ 979,133 $1,035,731 $ — $ —

Funded status ....................................... $ (301,415) $ (329,550) $(24,034) $(22,252)

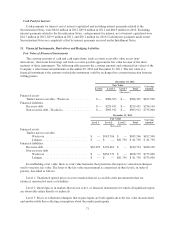

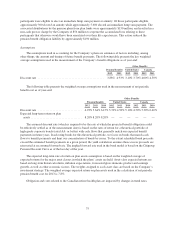

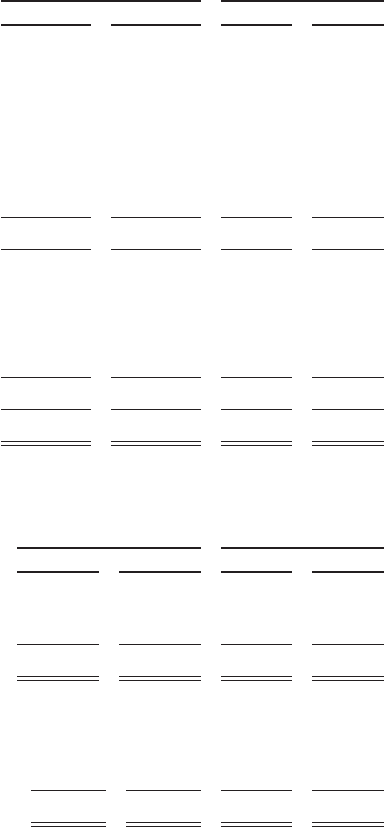

The following table shows the amounts recognized in the Consolidated Balance Sheets related to the

Company’s defined benefit pension and other postretirement benefit plans at year-end:

Pension Benefits Other Benefits

2012 2011 2012 2011

(thousands)

Current liabilities ...................................... $ (3,293) $ (6,530) $ (1,195) $ (1,243)

Noncurrent liabilities ................................... (298,122) (323,020) (22,839) (21,009)

Net amount recognized ................................. $(301,415) $(329,550) $(24,034) $(22,252)

Amounts recognized in accumulated other comprehensive loss consist of:

Net loss ............................................... $481,501 $548,212 $ 6,157 $ 4,486

Prior service cost (credit) ................................. — — (18,131) (22,138)

Total ................................................. $481,501 $548,212 $(11,974) $(17,652)

73