OfficeMax 2012 Annual Report Download - page 91

Download and view the complete annual report

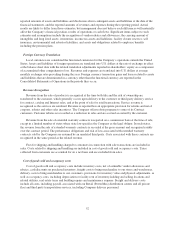

Please find page 91 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.an investment in Boise Cascade Holdings, L.L.C. (the “Boise Investment”) which is accounted for under the cost

method. In exchange for its investment in Boise Cascade Holdings, L.L.C., the Company received voting

securities and non-voting securities. The non-voting securities of Boise Cascade Holdings, L.L.C. accrue

dividends. It is the Company’s policy to record the income associated with the dividends on the non-voting

securities as a reduction of operating, selling and general and administrative expenses in the Consolidated

Statements of Operations. The voting securities do not accrue dividends. See Note 9, “Investment in Boise

Cascade Holdings, L.L.C.,” for additional information related to the Company’s investments in affiliates.

Capitalized Software Costs

The Company capitalizes certain costs related to the acquisition and development of internal use software

that is expected to benefit future periods. These costs are amortized using the straight-line method over the

expected life of the software, which is typically three to seven years. Other non-current assets in the Consolidated

Balance Sheets include unamortized capitalized software costs of $48.0 million and $32.5 million at

December 29, 2012 and December 31, 2011, respectively. Amortization of capitalized software costs totaled

$10.3 million, $10.5 million and $17.5 million in 2012, 2011 and 2010, respectively. Software development costs

that do not meet the criteria for capitalization are expensed as incurred.

Pension and Other Postretirement Benefits

The Company sponsors noncontributory defined benefit pension plans covering certain terminated

employees, vested employees, retirees and some active employees, primarily in Contract. The Company also

sponsors various retiree medical benefit plans. The type of retiree medical benefits and the extent of coverage

vary based on employee classification, date of retirement, location, and other factors. The Company explicitly

reserves the right to amend or terminate its retiree medical plans at any time, subject only to constraints, if any,

imposed by the terms of collective bargaining agreements. Amendment or termination may significantly affect

the amount of expense incurred.

The Company recognizes the funded status of its defined benefit pension, retiree healthcare and other

postretirement plans in the Consolidated Balance Sheets, with changes in the funded status recognized through

accumulated other comprehensive loss, net of tax, in the year in which the changes occur. Actuarially-determined

liabilities related to pension and postretirement benefits are recorded based on estimates and assumptions. Key

factors used in developing estimates of these liabilities include assumptions related to discount rates, rates of

return on investments, future compensation costs, healthcare cost trends, benefit payment patterns and other

factors.

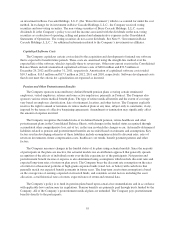

The Company measures changes in the funded status of its plans using actuarial models. Since the majority

of participants in the plans are inactive, the actuarial models use an attribution approach that generally spreads

recognition of the effects of individual events over the life expectancies of the participants. Net pension and

postretirement benefit income or expense is also determined using assumptions which include discount rates and

expected long-term rates of return on plan assets. The Company bases the discount rate assumption on the rates

of return for a theoretical portfolio of high-grade corporate bonds (rated AA- or better) with cash flows that

generally match our expected benefit payments in future years. The long-term asset return assumption is based

on the average rate of earnings expected on invested funds, and considers several factors including the asset

allocation, actual historical rates of return, expected rates of return and external data.

The Company’s policy is to fund its pension plans based upon actuarial recommendations and in accordance

with applicable laws and income tax regulations. Pension benefits are primarily paid through trusts funded by the

Company. All of the Company’s postretirement medical plans are unfunded. The Company pays postretirement

benefits directly to the participants.

55