OfficeMax 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s executive officers, key employees and nonemployee directors are eligible to receive awards

under the 2003 Plan at the discretion of the Executive Compensation Committee of the Board of Directors. Eight

types of awards may be granted under the 2003 Plan, including stock options, stock appreciation rights, restricted

stock, restricted stock units, performance units, performance shares, annual incentive awards and stock bonus

awards.

Restricted Stock and Restricted Stock Units

Restricted stock is restricted until it vests and cannot be sold by the recipient until its restrictions have

lapsed. Each restricted stock unit (“RSU”) is convertible into one share of common stock after its restrictions

have lapsed. The Company recognizes compensation expense related to these awards over the vesting periods

based on the awards’ grant date fair values. The Company calculates the grant date fair value of the RSU awards

by multiplying the number of RSUs by the closing price of the Company’s common stock on the grant date. If

these awards contain performance criteria the grant date fair value is set assuming performance at target, and

management periodically reviews actual performance against the criteria and adjusts compensation expense

accordingly. Pre-tax compensation expense and additional paid-in capital related to restricted stock and RSU

awards was $2.2 million, $5.6 million and $8.0 million for 2012, 2011 and 2010, respectively. The remaining

compensation expense to be recognized related to outstanding restricted stock and RSUs, net of estimated

forfeitures, is approximately $0.9 million. The remaining compensation expense is to be recognized through the

first quarter of 2015.

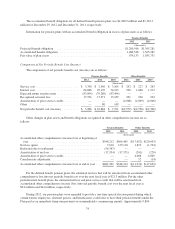

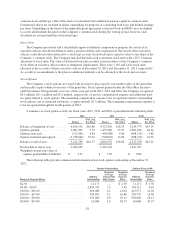

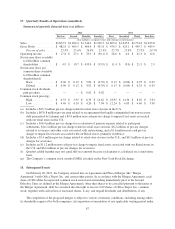

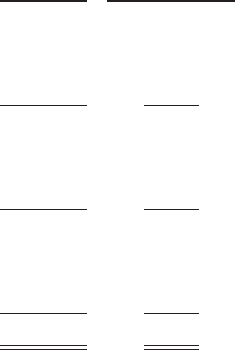

A summary of restricted stock and RSU activity for fiscal years 2012, 2011 and 2010 is presented in the

following table:

Shares

Weighted-Average

Grant Date Fair

Value Per Share

Nonvested, December 26, 2009 ........................................ 1,929,945 $16.24

Granted ....................................................... 872,534 13.81

Vested ........................................................ (1,492) 33.70

Forfeited ...................................................... (689,852) 20.34

Nonvested, December 25, 2010 ........................................ 2,111,135 $13.89

Granted ....................................................... 648,224 12.17

Vested ........................................................ (1,047,406) 15.77

Forfeited ...................................................... (223,703) 11.64

Nonvested, December 31, 2011 ........................................ 1,488,250 $12.15

Granted ....................................................... 653,385 5.66

Vested ........................................................ (694,293) 8.97

Forfeited ...................................................... (129,586) 11.18

Nonvested, December 29, 2012 ........................................ 1,317,756 $10.70

Restricted stock and RSUs are not included as shares outstanding in the calculation of basic earnings per share,

but, except as described below, are included in the number of shares used to calculate diluted earnings per share as

long as all applicable performance criteria are met, and their effect is dilutive. In the above table, nonvested RSUs

outstanding at the end of 2012 include 96,755 and 349,229 shares of performance-based RSUs granted in 2010 and

2011, respectively, that were to be forfeited after the end of 2012 because the performance measures with the

respect to those RSUs were not met. However, nonvested RSUs outstanding at the end of 2012 in the above table,

do not include 433,460 shares of performance-based RSUs that were reserved for issuance in 2012 but associated

performance measures were not established. Therefore, they are not considered granted or outstanding. All of those

RSUs have been excluded from the number of shares used to calculate diluted earnings per share. When the

restriction lapses on restricted stock, the par value of the stock is reclassified from additional paid-in-capital to

common stock. When the restriction lapses on RSUs, the units are converted to unrestricted shares of our

80