OfficeMax 2012 Annual Report Download - page 108

Download and view the complete annual report

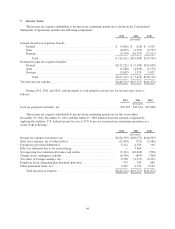

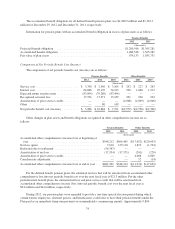

Please find page 108 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The carrying amounts shown in the table are included in the Consolidated Balance Sheets under the

indicated captions. The following methods and assumptions were used to estimate the fair value of each class of

financial instruments:

•Timber notes receivable: Timber notes receivable as of December 29, 2012 consists solely of the

Wachovia Guaranteed Installment Notes. The fair value of the Wachovia Guaranteed Installment Notes

is determined as the present value of expected future cash flows discounted at the current interest rate

for loans of similar terms with comparable credit risk (Level 2 inputs). In 2011, the fair value of the

Lehman Guaranteed Installment Note reflected the estimated future cash flows of the note considering

the estimated effects of the Lehman bankruptcy (Level 3 inputs).

•Recourse debt: The Company’s debt instruments are not widely traded. Recourse debt for which there

were trades on the last day of the period (the “measurement date”) was valued using the unadjusted

quoted price from the last trade on the measurement date (Level 1 input). Recourse debt for which

there were no transactions on the measurement date was valued based on quoted market prices near the

measurement date when available or by discounting the future cash flows of each instrument using

rates based on the most recently observable trade or using rates currently offered to the Company for

similar debt instruments of comparable maturities (Level 2 inputs).

•Non-recourse debt: Non-recourse debt as of December 29, 2012 consists solely of the Securitization

Notes supported by Wachovia. The fair value of the Securitization Notes supported by Wachovia is

estimated by discounting the future cash flows of the instrument at rates currently available to the

Company for similar instruments of comparable maturities (Level 2 inputs). In 2011, the Securitization

Notes supported by Lehman were estimated based on the future cash flows of the Lehman Guaranteed

Installment Note (the proceeds from which are the sole source of payment of this note) in a bankruptcy

proceeding (Level 3 inputs).

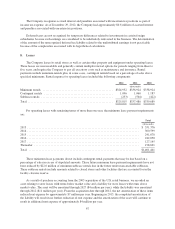

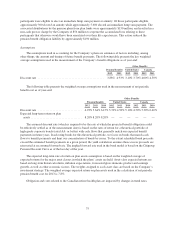

During 2012, there were no significant changes to the techniques used to measure fair value. During the

third quarter of 2012, the Lehman-related timber notes receivable were transferred and the Lehman-related non-

recourse debt was extinguished pursuant to an agreement related to the Lehman bankruptcy (for further

information see Note 4, “Timber Notes/Non-Recourse Debt”). Other than the Lehman activity, routine

borrowings and payments of recourse debt there were no changes to the financial instruments for which fair value

is being calculated. Any changes in the level of inputs for recourse debt is due to the existence or nonexistence of

trades on the measurement date from which to obtain unadjusted quoted prices.

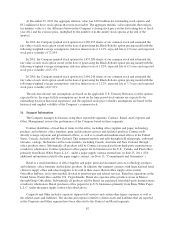

Derivatives and Hedging Activities

Changes in foreign currency exchange rates expose the Company to financial market risk. The Company

occasionally uses derivative financial instruments, such as forward exchange contracts, to manage its exposure

associated with commercial transactions and certain liabilities that are denominated in a currency other than the

currency of the operating unit entering into the underlying transaction. The Company does not enter into

derivative instruments for any other purpose. The Company does not speculate using derivative instruments. The

fair values of derivative financial instruments were not material at the end of fiscal year 2012 or 2011.

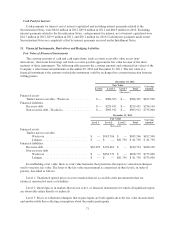

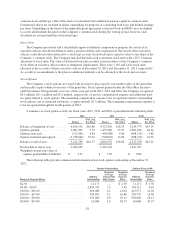

12. Retirement and Benefit Plans

Pension and Other Postretirement Benefit Plans

The Company sponsors noncontributory defined benefit pension plans covering certain terminated

employees, vested employees, retirees and some active employees, primarily in Contract. In 2004 or earlier, the

Company’s qualified pension plans were closed to new entrants and the benefits of eligible participants were

frozen.

72