OfficeMax 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

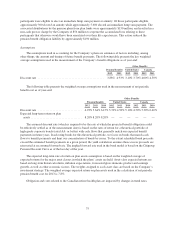

Management evaluates the segments’ performances using segment income (loss) which is based on

operating income (loss) after eliminating the effect of certain operating items that are not indicative of our core

operations such as facility closures and adjustments, asset impairments, severances and accelerated pension

expense related to participant settlements. These certain operating items are reported on the asset impairments

and other operating expenses, net lines in the Consolidated Statements of Operations.

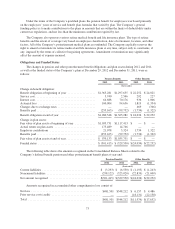

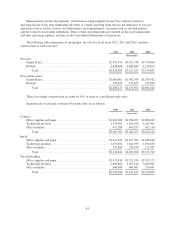

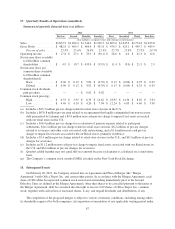

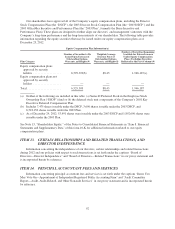

The following table summarizes by geography, net sales for fiscal years 2012, 2011 and 2010, and non-

current assets at each year-end:

2012 2011 2010

(thousands)

Net sales

United States ........................................... $5,491,976 $5,671,738 $5,770,036

Foreign ............................................... 1,428,408 1,449,429 1,379,971

Total ............................................. $6,920,384 $7,121,167 $7,150,007

Non-current assets

United States ........................................... $1,660,961 $1,992,674 $1,924,982

Foreign ............................................... 139,470 137,627 139,661

Total ............................................. $1,800,431 $2,130,301 $2,064,643

There is no single customer that accounts for 10% or more of consolidated trade sales.

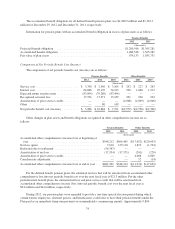

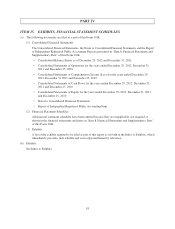

Segment sales to external customers by product line are as follows:

2012 2011 2010

(thousands)

Contract

Office supplies and paper ................................. $2,061,908 $2,076,052 $2,086,629

Technology products ..................................... 1,130,564 1,142,168 1,185,461

Office furniture ......................................... 413,288 405,857 362,154

Total ............................................. $3,605,760 $3,624,077 $3,634,244

Retail

Office supplies and paper ................................. $1,411,522 $1,437,304 $1,468,646

Technology products ..................................... 1,670,302 1,824,956 1,834,630

Office furniture ......................................... 232,800 234,830 212,487

Total ............................................. $3,314,624 $3,497,090 $3,515,763

Total OfficeMax

Office supplies and paper ................................. $3,473,430 $3,513,356 $3,555,275

Technology products ..................................... 2,800,866 2,967,124 3,020,091

Office furniture ......................................... 646,088 640,687 574,641

Total ............................................. $6,920,384 $7,121,167 $7,150,007

83