OfficeMax 2012 Annual Report Download - page 118

Download and view the complete annual report

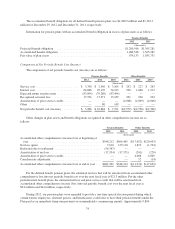

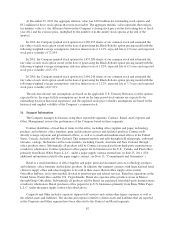

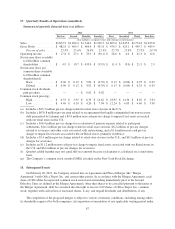

Please find page 118 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 29, 2012, the aggregate intrinsic value was $10.8 million for outstanding stock options and

$3.2 million for those stock options that were exercisable. The aggregate intrinsic value represents the total pre-

tax intrinsic value (i.e. the difference between the Company’s closing stock price on the last trading day of fiscal

year 2012 and the exercise price, multiplied by the number of in-the-money stock options at the end of the

quarter).

In 2012, the Company granted stock options for 2,087,453 shares of our common stock and estimated the

fair value of each stock option award on the date of grant using the Black-Scholes option pricing model with the

following weighted average assumptions: risk-free interest rate of 1.41%, expected life of 4.5 years and expected

stock price volatility of 72.59%.

In 2011, the Company granted stock options for 1,457,280 shares of our common stock and estimated the

fair value of each stock option award on the date of grant using the Black-Scholes option pricing model with the

following weighted average assumptions: risk-free interest rate of 1.92%, expected life of 4.5 years and expected

stock price volatility of 65.17%.

In 2010, the Company granted stock options for 2,060,246 shares of our common stock and estimated the

fair value of each stock option award on the date of grant using the Black-Scholes option pricing model with the

following weighted average assumptions: risk-free interest rate of 2.12%, expected life of 3.7 years and expected

stock price volatility of 67.21%.

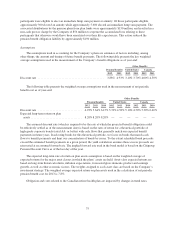

The risk-free interest rate assumptions are based on the applicable U.S. Treasury Bill rates over the options’

expected lives; the expected life assumptions are based on the time period stock options are expected to be

outstanding based on historical experience; and the expected stock price volatility assumptions are based on the

historical and implied volatility of the Company’s common stock.

14. Segment Information

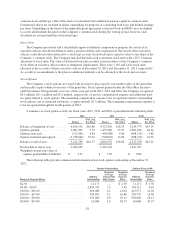

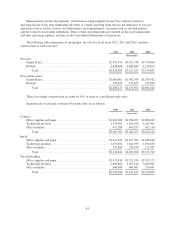

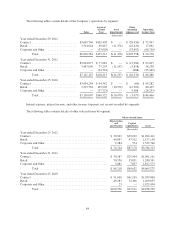

The Company manages its business using three reportable segments: Contract, Retail, and Corporate and

Other. Management reviews the performance of the Company based on these segments.

Contract distributes a broad line of items for the office, including office supplies and paper, technology

products and solutions, office furniture, print and document services and facilities products. Contract sells

directly to large corporate and government offices, as well as to small and medium-sized offices in the United

States, Canada, Australia and New Zealand. This segment markets and sells through field salespeople, outbound

telesales, catalogs, the Internet and in some markets, including Canada, Australia and New Zealand, through

office products stores. Substantially all products sold by Contract are purchased from third-party manufacturers

or industry wholesalers. Contract purchases office papers for its businesses in the U.S., Canada, and Puerto Rico

primarily from Boise White Paper, L.L.C., under a paper supply contract entered into on June 25, 2011. (For

additional information related to the paper supply contract, see Note 15, “Commitments and Guarantees”.)

Retail is a retail distributor of office supplies and paper, print and document services, technology products

and solutions, office furniture and facilities products. In addition, this segment contracts with large national retail

chains to supply office and school supplies to be sold in their stores. Retail office supply stores feature

OfficeMax ImPress, an in-store module devoted to print-for-pay and related services. Retail has operations in the

United States, Puerto Rico and the U.S. Virgin Islands. Retail also operates office products stores in Mexico

through Grupo OfficeMax. Substantially all products sold by Retail are purchased from third-party manufacturers

or industry wholesalers. Retail purchases office papers for its U.S. businesses primarily from Boise White Paper,

L.L.C., under the paper supply contract described above.

Corporate and Other includes corporate support staff services and certain other legacy expenses as well as

the related assets and liabilities. The income and expense related to certain assets and liabilities that are reported

in the Corporate and Other segment have been allocated to the Contract and Retail segments.

82