OfficeMax 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Changes in foreign currency exchange rates expose us to financial market risk. We occasionally use

derivative financial instruments, such as forward exchange contracts, to manage our exposure associated with

commercial transactions and certain liabilities that are denominated in a currency other than the currency of the

operating unit entering into the underlying transaction. We generally do not enter into derivative instruments for

any other purpose. We do not speculate using derivative instruments.

The estimated fair values of our other financial instruments, including cash and cash equivalents and

receivables are the same as their carrying values. Concentration of credit risks with respect to trade receivables is

limited due to the wide variety of vendors, customers and channels to and through which our products are

sourced and sold, as well as their dispersion across many geographic areas. In the fourth quarter of 2011, we

became aware of financial difficulties at one of our large Contract customers. We granted the customer extended

payment terms and implemented creditor oversight provisions. The receivable from this customer was $30

million at December 29, 2012, and substantially all of that balance has been collected to date. Based on our

ongoing sales to this customer, we continue to carry similar receivable balances, which we monitor closely.

Asset Impairments

We are required for accounting purposes to assess the carrying value of other intangible assets annually or

whenever circumstances indicate that a decline in value may have occurred. No impairment was recorded related

to other intangible assets in 2012, 2011 or 2010.

For other long lived assets, we are also required to assess the carrying value when circumstances indicate

that a decline in value may have occurred. Based on the operating performance of certain of our retail stores due

to the macroeconomic factors and market specific change in expected demographics, we determined that there

were indicators of potential impairment relating to our retail stores in 2012, 2011 and 2010. Therefore, we

performed the required impairment tests and recorded non-cash charges of $11.4 million, $11.2 million and

$11.0 million, respectively, to impair long-lived assets pertaining to certain retail stores.

Facility Closure Reserves

We conduct regular reviews of our real estate portfolio to identify underperforming facilities, and close

those facilities that are no longer strategically or economically beneficial. We record a liability for the cost

associated with a facility closure at its estimated fair value in the period in which the liability is incurred,

primarily the location’s cease-use date. Upon closure, unrecoverable costs are included in facility closure

reserves and include provisions for the present value of future lease obligations, less contractual or estimated

sublease income. Accretion expense is recognized over the life of the payments.

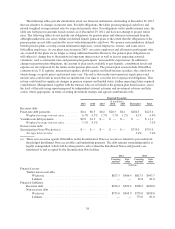

In 2012, we recorded charges of $41.0 million related to the closing of 29 underperforming domestic stores

prior to the end of their lease terms, all of which was associated with the lease liability. During 2011, we

recorded charges of $5.6 million related to the closing of six underperforming domestic stores prior to the end of

their lease term, of which $5.4 million was related to the lease liability and $0.2 million was related to asset

impairments. In 2010, we recorded charges of $13.1 million related to facility closures, of which $11.7 million

was related to the lease liability and other costs associated with closing eight domestic stores prior to the end of

their lease terms.

At December 29, 2012, the facility closure reserve was $74.6 million, with $21.8 million included in current

liabilities and $52.8 million included in long-term liabilities. The vast majority of the reserve represents future

lease obligations of $126.8 million, net of anticipated sublease income of approximately $52.2 million. Cash

payments relating to the facility closures were $20.7 million in 2012 and $22.3 million in both 2011 and 2010.

We anticipate payments in 2013 to be approximately $22 million.

In addition, we were the lessee of a legacy, building materials manufacturing facility near Elma,

Washington until the end of 2010. During 2006, we ceased operations at the facility, fully impaired the assets and

39