OfficeMax 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion contains statements about our future financial performance. These statements are

only predictions. Our actual results may differ materially from these predictions. In evaluating these statements,

you should review “Item 1A. Risk Factors” of this Form 10-K, including “Cautionary and Forward-Looking

Statements.”

Overall Summary

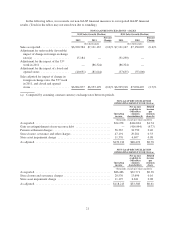

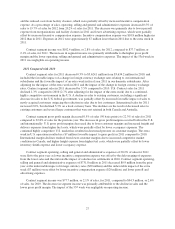

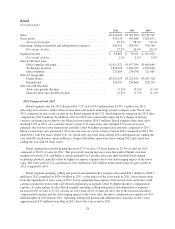

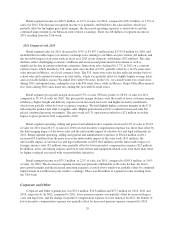

Sales for 2012 were $6,920.4 million, compared to $7,121.2 million for 2011, a decrease of 2.8%. Fiscal

year 2011 contained an extra week of sales for our domestic businesses ($86 million), which negatively impacted

2012 sales comparisons. In addition, sales for 2012 were negatively impacted by a change in foreign currency

exchange rates ($15 million). After adjusting for the impact of the extra week in 2011, the impact of the change

in foreign currency exchange rates and the impact of stores closed and opened during 2011 and 2012, sales in

2012 declined by 0.8% compared to 2011.

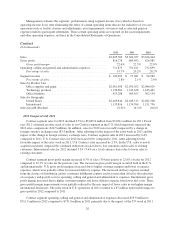

Consolidated gross profit margin increased by 0.4 % of sales (40 basis points) to 25.8 % of sales in 2012

compared to 25.4% of sales in 2011, as higher customer margins and lower occupancy expense were partially

offset by higher delivery expense.

Operating, selling and general and administrative expenses declined during 2012 due primarily to reduced

costs from facility and store closures and the impact of the extra week in 2011, which were partially offset by

higher incentive compensation expense. As a percentage of sales, expenses increased slightly as the impact of

increased incentive compensation expense was nearly offset by the lower costs from facility closures and the

impairment of store assets in 2011.

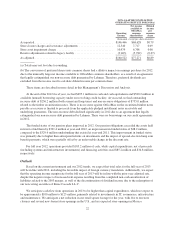

We reported operating income of $24.3 million in 2012 compared to $86.5 million in 2011. As noted in the

discussion and analysis that follows, our operating results were impacted by a number of significant items in both

years. These items included charges for the acceleration of pension expense related to participant settlements,

asset impairments, store closures and severance. If we eliminate these items, our adjusted operating income for

2012 was $139.2 million compared to an adjusted operating income of $118.2 million for 2011. The reported net

income available to OfficeMax common shareholders was $414.7 million, or $4.74 per diluted share, in 2012

compared to $32.8 million, or $0.38 per diluted share, in 2011. If we eliminate the impact of the significant items

recorded in operating income discussed above as well as the gain related to an agreement that legally

extinguished our non-recourse debt guaranteed by Lehman Brothers Holding, Inc. (“Lehman”) from the

applicable periods, and the related income tax effects, our adjusted net income available to OfficeMax common

shareholders was $68.5 million, or $0.78 per diluted share, compared to $53.3 million, or $0.61 per diluted share,

for 2011. We estimate that the 53rd week added $8 million of operating income and $0.06 of diluted earnings per

share in 2011.

On February 20, 2013, the Company entered into an Agreement and Plan of Merger (the “Merger

Agreement”) with Office Depot, Inc. and certain other parties. In accordance with the Merger Agreement, each

share of OfficeMax Incorporated common stock issued and outstanding immediately prior to the Second

Effective Time (as defined in the Merger Agreement), other than shares to be cancelled pursuant to the terms of

the Merger Agreement, shall be converted into the right to receive 2.69 shares of Office Depot, Inc. common

stock, together with cash in lieu of fractional shares, if any, and unpaid dividends and distributions, if any.

The completion of the proposed merger is subject to various customary conditions, including among others

(i) shareholder approval by both companies, (ii) expiration or termination of any applicable waiting period under

the Hart-Scott-Rodino Antitrust Improvement Act of 1976, and (iii) effectiveness of a registration statement

registering Office Depot, Inc. common stock.

19