OfficeMax 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.92

There are twelve operating leases that havebeen assigned to other parties but for which the

Company remains contingently liable in the event of nonpayment by the other parties. The lease terms

vary and, assuming exercise of renewal options, extend through 2032. Annual rental payments under

these leases are approximately $3.4 million.

The Company and its affiliates enter into a wide range of indemnification arrangements in the

ordinary course of business. These include tort indemnifications, tax indemnifications, officer and

director indemnifications against third-party claims arising out of arrangementstoprovide services to the

Company and indemnifications in merger and acquisition agreements. It is impossible toquantify the

maximum potential liability under these indemnifications. At December 30, 2006, the Company is not

aware of any material liabilities arising from these indemnifications.

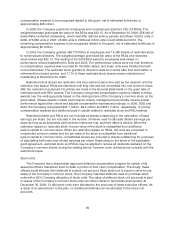

19. Legal Proceedings and Contingencies

OfficeMax Incorporated and certain of its subsidiaries are named as defendants in a number of

lawsuits,claims and proceedings. Some ofthese lawsuits and proceedings arose out of the operation of

the paperand forest products assets prior to the closing of the Sale, for which OfficeMax agreed to

retain responsibility. Also, as partofthe Sale, the Company agreed to retain responsibility forall pending

or threatened proceedings and future proceedings alleging asbestos-related injuries arising out of the

operation of the paper and forest products assets priorto the closing of the Sale. The Company does

not believe any of these retained proceedings are material to its business.

The Company has beennotified that it is a “potentially responsibleparty” under the Comprehensive

Environmental Response Compensationand Liability Act (“CERCLA”) or similar federal and state laws,

or has received a claim from a private party, with respect to 12 active sites where hazardous substances

or other contaminants are or may be located. All 12active sites relate to operations either no longer

owned by the Company orunrelated to its ongoing operations. In most cases, the Company is oneof

many potentially responsible parties, and its alleged contribution to these sites is relatively minor. For

sites where a range of potential liability can be determined, theCompany has established appropriate

reserves. The Companybelieves it has minimal orno responsibility withregardtoseveral other sites.

The Company cannot predict with certainty the total responseand remedial costs, its share of the total

costs, the extent to which contributions will be available from other parties or the amount of time

necessary to complete the cleanups. Based on its investigations; its experience with respect to cleanup

of hazardous substances; the fact that expenditureswill, in many cases, be incurred over extended

periods of time; and the number of solvent potentially responsible parties; the Company does not

believe that the knownactual and potential response costs will, in the aggregate, materially affect its

financial position or resultsof operations.

Over the past several years and continuing into 2006, the Company has been named a defendant in

a number of cases where the plaintiffs allege asbestos-related injuries from exposure to asbestos

products or exposure to asbestos while working at job sites. The claims vary widelyand often are not

specific about the plaintiffs’ contacts with the Company. None ofthe claims seeks damages from the

Company individually, and the Company is generally one of numerous defendants. Many of the cases

filed against us have been voluntarilydismissed, although the Company has settled some cases. The

settlements have been covered mostly by insurance, and the Company believes anyfuture settlements

or judgments in these cases would be similarly covered. To date, noasbestos case against the

Company has gone to trial, and the nature of these casesmakes any prediction as to the outcome of

pendinglitigation inherently subjective. At this time, however, the Company believes its involvement in

asbestos litigation is not material to either its financial position or its results of operations.

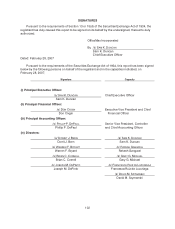

The Company and several former officers and/or directors ofthe Company or its predecessor are

defendants in a consolidated, putative class action proceeding (Roth v. OfficeMax Inc., et. al, U.S.

District Court, Northern District of Illinois) alleging violationsofthe Securities Exchange Act of 1934. The