OfficeMax 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

The closure of certain facilities acquired in the OfficeMax, Inc. acquisition was accounted for in

accordance with EITF Issue No.95-3, “Recognition of Liabilities in Connection With a Purchase

Business Combination.” Theestimated costs to be incurredin closing these facilities were accrued in

connection with the acquisition,and did notresult in a charge to incomein theCompany’s

ConsolidatedStatements of Income (Loss).

Environmental Matters

The Company has adopted the provisions of SFAS No. 143, “Accounting for Asset Retirement

Obligations,” in accounting for landfill closure costs related to the sold paper, forest products and

timberland assets. This statement requires legal obligations associated with the retirement of long-

lived assets to be recognized attheir fairvalue at the time the obligations are incurred. Upon initial

recognition of a liability, that cost is capitalized as part of the related long-lived asset and depreciated

on a straight-line basis over the remaining estimated useful life of the asset. Accretion expense on the

discounted liability is also recognized over the remaining useful life of the asset. At December30,

2006 and December 31, 2005, the asset retirement obligation for estimated closure and closed-site

monitoring costs recorded on theCompany’s Consolidated BalanceSheet was $4.2million for both

years. These obligations are related to assets held for sale.

Under the terms of the Sale, environmental liabilities that relate to the operation of the paper,

forest products and timberland assets prior to the closing of the Sale transaction were retainedby the

Company. These environmental obligations are not withinthe scope of SFAS No. 143, and the

Company accrues for losses associated withthese types of environmental remediation obligations

when such losses are probable and reasonably estimable according to the guidance in SOP 96-1,

“Environmental Remediation Liabilities.”The liabilities for environmental obligations are not

discounted to their present value. (See Note 19, Legal Proceedingsand Contingencies, foradditional

information.)

Self-insurance

The Company is self-insured for certain losses related to workers’ compensation andmedical

claims as well as general and auto liability. The expected ultimate cost for claims incurred is

recognized as a liability in the Consolidated BalanceSheets. The expected ultimate cost of claims

incurred is estimated based principally on analysis of historical claim data and actuarial estimates of

claims incurred but not reported. Losses are accrued and charged to operations when it is probable

that alosshas been incurred and the amount can be reasonably estimated.

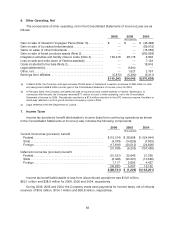

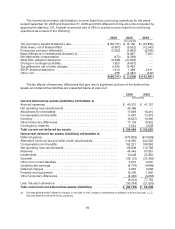

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and

liabilities are recognized for the future tax consequences attributable to differences between the

financial statement carrying amounts ofexisting assets and liabilities and their respective tax bases

and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using

enacted tax rates expected to apply to taxable income inthe years in which thosetemporary

differencesare expected to be recovered or settled.The effect ondeferred tax assets and liabilities of

a change in tax rates isrecognized in income in the period that includes the enactment date.