OfficeMax 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

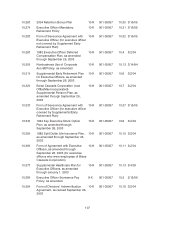

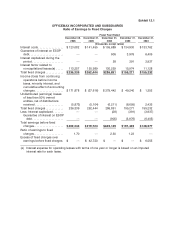

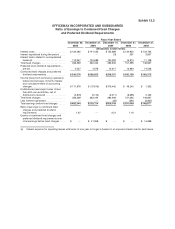

Exhibit 12.1

OFFICEMAX INCORPORATED AND SUBSIDIARIES

Ratio of Earnings to Fixed Charges

Fiscal Year Ended

December 30,

2006

December 31,

2005

December 31,

2004

December 31,

2003

December 31,

2002

(thousands, except ratios)

Interest costs................. $ 123,082 $ 141,455$ 155,689 $ 134,930 $133,762

Guarantee ofinterest onESOP

debt....................... ——905 3,976 6,405

Interest capitalized during the

period ..................... ——28 3913,937

Interest factorrelated to

noncapitalized leases(a) ..... 113,257 120,989130,229 15,974 11,128

Total fixedcharges ............ $ 236,339$ 2 62,444 $ 286,851$ 1 55,271 $ 155,232

Income (loss) from continuing

operations before income

taxes, minority interest, and

cumulative effect of accounting

changes................... $171,878 $(37,616) $379,442 $49,240 $ 1,352

Undistributed (earnings)losses

of less than 50% owned

entities, net of distributions

received ................... (5,873) (5,104) (6,211) (8,695) 2,435

Totalfixed charges............ 236,339 262,444 286,851 155,271 155,232

Less: Interest capitalized....... ——(28) (391) (3,937)

Guarantee of interest onESOP

debt..................... ——(905)(3,976) (6,405)

Total earnings beforefixed

charges. ................... $ 402,344$ 2 19,724 $ 659,149$ 1 91,449 $ 148,677

Ratio of earnings to fixed

charges. ................... 1.70 — 2.30 1.23—

Excess offixed charges over

earnings before fixed charges $ —$42,720 $ —$ — $ 6,555

(a) Interest expense for operating leaseswith terms of one year or longer is based on animputed

interest rate for each lease.